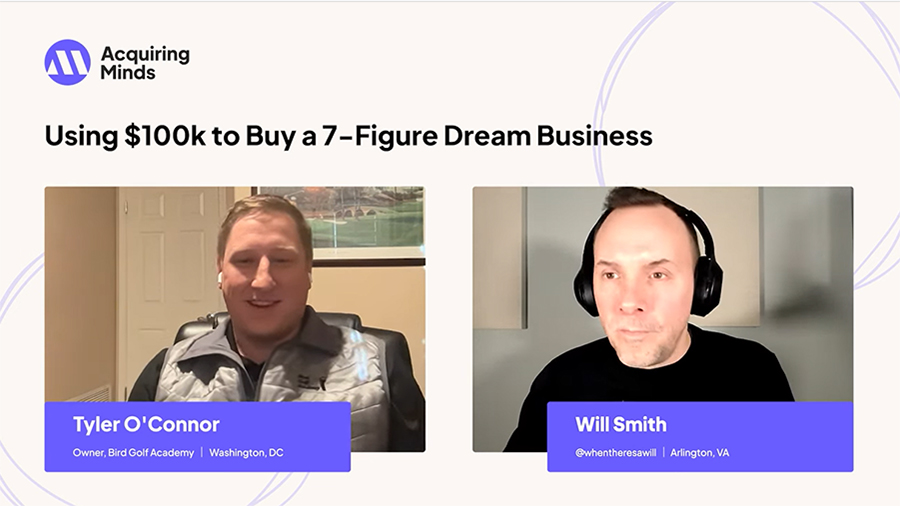

Army Vet Hits a Hole-in-One Buying Bird Golf Academy

Find Out How Tyler O'Connor Acquired Bird Golf Academy - And Why He Did It

“I come from an entrepreneurial family. My dad was an entrepreneur,” Tyler O’Connor, recently recounted on an episode of the Acquiring Minds podcast. “I knew I always wanted to get into this space and do my own thing. I think everyone's dream is to be their own boss.”

To that end, Tyler recently acquired Bird Golf Academy, a company with 20 golf schools across the US.

Leaving the W-2 and Scratching the Entrepreneurial Itch

Despite his family’s history of embracing entrepreneurship, Tyler first followed a more traditional path.

He got his undergraduate degree at Arizona State University and was then quickly commissioned as an officer in the Army, where he served several tours of duty in Afghanistan and Washington D.C. over the span of six years.

Next up was an MBA from George Washington University with a focus in entrepreneurship and sports management, then four and a half years of government consulting.

“I think by the end of it I was ‘quiet quitting’ before ‘quiet quitting’ was a thing,” he joked. “I was just so bored and not interested.”

Tyler’s entrepreneurial itch returned, along with the confidence that he’d built up the skill sets needed to strike out on his own.

In early Spring of 2022, Tyler attended a work conference where he chatted with a couple of budding business school students, who spoke passionately about the concept of a search fund. This got the wheels spinning for Tyler.

‘What if he wanted to do this himself, without getting traditional search fund investors?, he wondered. That’s when his new connections told him about an alternative approach to acquiring a small business, “self-funded searching”. Rather than first going to an installed base of investors, self-funded searchers use their own money or go to friends and family to cover their expenses during the search process.

“All these light bulbs started going off in my head,” Tyler recalled. “I was so energized and so excited.”

Getting Spouse Support to Buy a Business

Tyler’s first challenge was convincing his wife to get on board with the uncertainty of him quitting his job to devote himself to searching full time for a business to buy.

“I immediately went to my wife, and I said, ‘Listen, I've got a plan. I've got a roadmap. I know how to do this. I know the steps involved. And I want to do this.'”

It was a financial risk because the couple had two mortgages — which he acknowledged, then found a way to mitigate. Tyler and his wife decided to sell their investment property and use the proceeds to sustain themselves while he searched.

He gave himself two years, the amount of time he anticipated their savings would last.

“This was at the end of February, beginning of March, 2022,” Tyler said.

Searching for a Business to Love

By April, Tyler had started the preliminary steps of executing on his plan, though he didn’t intend to fully immerse himself until July, after some military commitments that were coming up.

Still, he worked on forming an LLC as he began browsing business for sale listings on BizBuySell every night.

At first, he searched for the traditional targets of many acquisition entrepreneurs, like HVAC businesses. He put out feelers to brokers, and even looked over some CIMs (confidential information memorandums).

Then, over Easter weekend, he shared his plans and objectives with his mom. She encouraged him to look for a business he was actually passionate about, instead of choosing one that would bore him, like HVAC or small manufacturing.

“I had never once thought like, let me do something that I really love,” Tyler confessed.

The next night he went on BizBuySell, but this time the avid golfer decided to search for a golf business. He just wanted to see what was out there. Most of the listings were for golf courses or real estate.

Then he saw the Bird Golf Academy listing, which he could’ve easily overlooked because the company description was short and didn’t even include a picture. He emailed the broker right away.

“Come to find out golf is this lucrative industry,” he said. The deeper he dug, the more he spoke with the broker, the better he felt about it. “I see these massive tailwinds in the industry.”

Details of the Golf School Business

Bird Golf Academy, founded in 1999, offers multi-day golf schools taught by over a dozen former PGA circuit pros at more than 20 partner golf courses across the US (including in Florida, California, Arizona, Oregon, Pennsylvania, and Vermont).

It had been doubling in revenue every year for the past few years and was projected to bring in seven figures with over 30% margins (so, just around $1 million EBITDA). The cash flow cycle was also good, with students paying upfront and business expenses getting paid later.

All this excited Tyler so much that he didn’t totally believe his luck. He knew how rare it was that an entrepreneur ends up buying the first business they set their sights on. In general, he said, it ends up being the third LOI that hits.

In his own words, he was “waiting for the house of cards to fall.”

But he kept pursuing it and chose to look at what others might consider negatives in a positive light.

For example, while other investors might have seen the business’s staff of older instructors as a risk, Tyler focused on the upside of employee loyalty and the name recognition the pros had among the company’s older-trending customer base.

“If you were to look at the resumes of our instructors,” Tyler said, “you could put us against any of these [other] schools...Our bona fides would match up with any of those big names. Hands down, we've got former Majors champions…They're real, professional instructors.”

Convincing Other Key Players: The Bank and the Seller

Tyler did have to do a little more lifting to convince the bank to grant him an SBA loan, as the SBA is often reluctant to fund fast-growing businesses because they offer less predictability than businesses that grow more gradually. It’s important for buyers to ask themselves if the growth they see is a fluke, or if it’s actually sustainable, he advised.

Case in point: Bird Golf Academy surged during COVID, so 2021’s numbers were not representative of Bird Golf Academy’s long-term trajectory.

That’s where Tyler’s own expertise and experience was invaluable.

“I was OK with it myself,” he said. “I golfed all the time. I saw what the industry was doing and how COVID gave golf a huge bump, and I didn’t think that was going away anytime soon.”

When it came to talking to the bank, Tyler and his team got a Q of E (quality of earnings) done by a third party to verify the EBITDA against what was reported. That made the bank more comfortable and allowed Tyler to secure the type of deal he wanted to make.

Another potential bump in the road, Tyler thought, was that the seller was getting lots of other offers. Somewhere around thirty other buyers had reached out. Tyler and the seller weren’t exclusive and, while waiting on the Q of E, Tyler recalled sweating over whether a better offer would come in and he’d lose the $20,000 he’d already invested in hiring the Q of E firm and other transaction costs.

But Tyler had an edge there too: the relationship he’d developed with the business’s original owner (the seller).

“He wanted to sell to a person who would take this company forward for the next 20 years, not necessarily a corporation,” Tyler explained.

Mechanics of the Deal

Tyler and his team originally proposed a deal with 15% seller financing, and his equity injection would be around $400,000. The SBA loan was going to cover the rest (about 75%), and they’d figure out the working capital later on.

Ultimately, they wrapped the non-competes and consulting fees into the seller financing, resulting in a 20% seller note, part of which was a seller standby note.

“So by the end, it was roughly 20% seller financed, 75% with the SBA, and then I came up with the other 5%,” Tyler said.

Another snag occurred when it came to his investors, the people who would contribute to the $400,000 equity injection alongside Tyler.

He was originally going to go in with four other equity investors, all friends of his. The investor who’d planned to inject the most capital ($175,000) was doing so from his self-directed pension fund. However, right before the deal closed — as interest rates climbed — Tyler was advised that continuing with that investor would require an additional round of SBA scrutiny (aka: delays and more hoops to jump through).

“So here we are, 24 hours before the deal is about to close,” Tyler, who is based in Washington, D.C., said.

“I’m driving down Rock Creek Parkway, I'm coming up next to the Kennedy Center, I've got the Lincoln Memorial on my left-hand side. I call the broker…and I tell him the situation. [I tell him] ‘here's what I'm willing to do…let's go back on the working capital number. If the seller will take this $175,000 as a second note on standby, then we can possibly make this thing happen.’”

Ten minutes later, the seller’s broker called Tyler back to let him know the seller was on board. Not only did this quick pivot save Tyler’s dream deal, it also resulted in him retaining more equity than he’d initially expected, which would’ve otherwise gone to the investor who needed to drop out.

All in all, Tyler invested somewhere between $80,000 - $100,000 of his own cash to acquire a $3-4 million business and retain about 90% ownership of it.

Buying a Business Is All About Relationships

One of the biggest themes running through Tyler’s story is the importance of connecting and building valuable relationships.

For example, when the question of how to best educate himself came up early on, Tyler decided to attend a search fund boot camp in Florida. There, he not only learned everything he needed, but also met his banker, Q of E provider, and lawyer. It put him in a cohort with others who were in the same boat, which facilitated the opportunity to bounce ideas and brainstorm.

He made another key connection — the broker — on BizBuySell. The broker’s experience had been mostly in selling and buying golf courses, not the exact business type Tyler was going after. But he and Tyler hit it off and kept in consistent contact throughout the deal.

Another aspect to Tyler’s deal that was a bit unusual was his eagerness to bring on friends as his investors.

“I think that's such an important thing for searchers to understand,” Tyler stressed. “Yeah, you can go out and get investor money. But it's so much better to do it with your buddies.”

He even fronted one of his investor-friends the $50,000 needed to come into the business as a small equity owner.

Post-Acquisition and Future Plans

Thanks to support from the seller, Bird Golf Academy’s ownership transition has been smooth for everyone.

Some of Tyler’s early wins since settling in include raising the instructors’ pay and digitizing the internal scheduling process.

Tyler is planning more operational tweaks to help grow the business in the coming years. One of those is dynamic pricing, so that students have more options and the business better capitalizes on peak times, instead of offering the same price for all schools regardless of season.

Bird Golf Academy is also looking to establish schools in key areas currently missing from their roster, like Tampa, Napa, and Texas. Tyler may not stop there; he’s looking at one day branching out internationally to the home of golf, the UK.

The company is also creating its own app so all the instructors can more easily share their individual tips and lessons.

Tyler’s Best Advice to Acquisition Entrepreneurs: Just Start

“I remember the first couple emails I sent to the broker,” Tyler said with a chuckle.

“I was sending them from my personal Gmail. A week or two into the deal, I started sending him emails from my search fund Callback Capital,” he said, referring to his newly-formed LLC.

These early “missteps” on Tyler’s part ultimately didn’t make much of a difference.

“There's no reason to wait. Just get into it. Get started. Who cares about your email or what your website looks like? If you see a deal you like, you gotta go after it.”

He also advises entrepreneurs to not buy into the way some folks on Twitter hype up quitting a W-2 job and becoming a full-time searcher as a victory in and of itself.

“You're not even close,” Tyler warns. “The goal is not to be a searcher. The goal is to be an operator.”

He also acknowledges the need for a roadmap, a plan, someone to lay out all the steps, alongside bold action. That’s what he found by building relationships with people at that first conference and later the boot camp.

Finally, Tyler “highly recommends” BizBuySell.

“All I can say is, I had a great experience with BizBuySell,” he recalls. “One of the first things you should do is…get on there and thumb around, see what's available, see what kind of prices there are, look at different multiples, things like that.”