Restaurant Transactions Jump 20% in 2022, Outpacing Small Business Acquisitions by a 4 to 1 Margin

Small Business Acquisitions Increased 4.7% while Restaurant Sales Grow 20% for the Same Period Last Year Amid Continued Concerns Around Inflation, Hiring, Interest Rates and the Economy

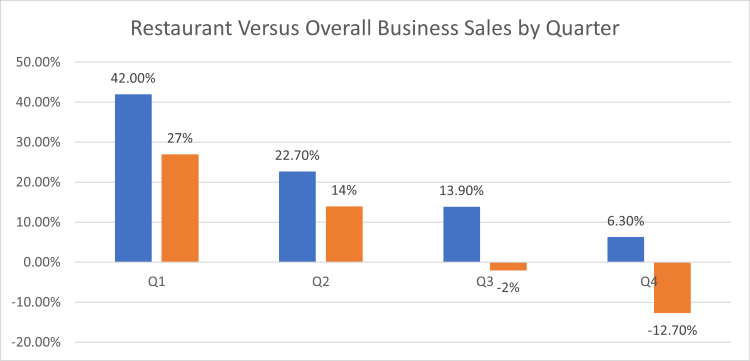

Restaurant transactions are outpacing the overall business for sale marketplace with noticeable cooling for all transactions by year’s end. That’s according to data recently published by BizBuySell’s Quarterly Insight Report, a nationally recognized economic indicator that tracks the health of the U.S. small business economy.

Restaurant transactions slowed each quarter before reaching single digit gains of just 6.3% in the last three months. Overall business sales were considerably below the mark set by restaurants and slowed significantly as well by fourth quarter posting negative gains in both third and fourth quarter. While restaurant sales have strongly recovered from the low point of 2020, they have not yet returned to 2019 levels (pre-pandemic) transaction levels, remaining more than 20% below that mark.

Median Selling Prices and Interest Rate Impact on Restaurants

The median selling price of restaurants turned in a strong performance, with restaurants trading 14% over the prior year’s selling prices at $249,000 versus $220,000 in 2021. All four quarters of restaurant sales posted gains to the median selling prices of 2021, another finding that is at odds with the total 2022 business for sale marketplace which posted a decline. Median sale prices for all small businesses dropped 3% to an average of $315,000.

One explanation for the healthier outlook of selling prices for restaurants versus other small businesses is a lower overall cost of entry. The data shows restaurants traded at roughly 21% less than the general business for sale marketplace ($249,000 versus $315,000). Those purchasing restaurants have smaller loans requiring lower repayment costs, which are less impacted by rising interest rates and the overall cost of capital.

The ability to get funding for restaurants has traditionally been more difficult, with some SBA lenders avoiding the space altogether. For that reason, those specializing in restaurant sales, like We Sell Restaurants, have been using alternative funding sources for many years, including unsecured lending, higher capital commitments from buyers, home equity lines of credit, seller financing, and specialized lenders. For restaurants, seller financing is frequently called upon to either bridge a gap in funding or provide additional security for the lender or borrower. Expect this trend to continue with ongoing pressure on interest rates.

Analysts agree that more rate hikes are on the horizon for 2023, subjecting deals to higher stress testing. In December, the Federal Reserve voted unanimously to raise the interest rate paid on reserve balances to 4.4%. The minutes of the meeting stated the committee anticipates ongoing increases, “in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

Restaurants are somewhat better positioned than other small businesses when it comes to interest rates since they are less likely to carry costly lines of credit. Their inventory is perishable, has a short shelf life and turns over frequently. That makes inventory easier to control and less costly than sourcing product over a long supply chain and in advance of need. Small businesses that must purchase large inventories or carry materials to create products have higher capital costs, and therefore, are more impacted by the interest rate hike. These are factors that could influence those in the market to buy a business with uncertainty around rates continuing.

Thus, lower notes, smaller purchase prices, and less need for lines of credit are reasons restaurants may continue to see transactions ahead of the traditional business for sale marketplace despite continued pressure on lending. That’s important since 53% of all business owners surveyed by BizBuySell say rate hikes are negatively impacting their business.

Restaurants Report Higher Median Revenue Outpacing Overall Business Transactions

The median revenue of restaurants sold rose in fourth quarter by 7% after declining by 16% in third quarter. Annually, median revenue of restaurants sold was positive, at 7.8% with this year’s revenue at $673,413 versus last year’s $625,419. That data point outperforms the business for sale marketplace where median revenue of all businesses sold reported by BizBuySell declined 2% to $650,000, below the median mark for restaurants.

Business owners surveyed by BizBuySell overwhelmingly agree (74%) that inflation is not easing. Restaurants have increased menu pricing to keep pace with the rising costs at a rate of 8.2% over the last year as reported by the Bureau of Labor Statistics. At the same time, consumers experienced an 11.8% increase in food at home, ranging from basics like cereals and bakery products rising 16.1% to increases of 7.7% for meats, poultry, fish, and eggs.

Overall, the U.S. Consumer Price Index Summary states that index for full-service meals rose 8.2% over the last 12 months, and the index for limited-service meals rose 6.6% over the same period. Simply put, it costs less for customers to dine out than to purchase groceries at a premium of 11.8% over last year and prepare food at home.

This is a welcome finding for restaurants that can maintain share of wallet from consumers with prices below that of purchasing supplies and cooking at home, which bodes well for the restaurant for sale marketplace. There are additional benefits to dining out, including: large food portions frequently turn a restaurant experience into more than one meal, the entertainment value of dining out and the luxury of meals without the requirement to shop and prepare food or clean the kitchen.

Restaurant Deals Turning Over Fast

Days on market, the measure of time between listing and sale, also improved for restaurants, declining to 169 from 176, indicating the market is moving more quickly. The shorter days on market may be attributed to less traditional lending associated with deals, which can increase deal complexity and time to close.

Restaurants Facing Continued Challenges Adapt Their Business Model

Restaurants sold last year reported median cash flow up 13% over 2021, according to the BizBuySell Insight Report. That is nearly four times the rate of increase in median cash flow reported for all businesses, which was just 3.4%

However, a survey of 3,000 owners conducted by the National Restaurant Association (NRA) found operators are not forecasting improving results for the future. Of the operators surveyed, only 16% of operators think their restaurant will be more profitable in 2023 than it was in 2022. Fully 50% think they will be less profitable in 2023, while 34% expect their profitability to remain about the same.

When asked if food costs, labor costs, and energy and utility costs were a “significant challenge,” a “moderate challenge”, or “little to no challenge” for their restaurants, the results show restaurants view the current conditions as a significant challenge for their business.

- 92% of all restaurants say Food Costs are a significant challenge

- 89% of all restaurants say Labor Costs are a significant challenge

- 63% say Energy and Utility Costs are a significant challenge

Despite these trials, restaurant operators are not sitting on the sidelines in the face of adversity and are actively making changes to the business to impact profitability. Restaurants are focusing intensely on where they can impact food, labor, and energy costs they see as a formidable challenge.

The NRA survey found that in response to rising costs and pressure on their supply chain, 87% of restaurants increased menu prices. Nearly six in 10 (59%) changed the food and beverage items offered on the menu. These actions will lower operating costs through reduced complexity and reduce inventory requirements.

In addressing labor shortages, 48% of restaurants reduced hours of operation or days open. One in three (32%) closed on days they would normally be open. 35% of operators say they stopped operating at full capacity, taking lessons from operating with a smaller dining room during the pandemic. These steps are reducing overhead and increasing profit margins. In the pre-pandemic model, the push to be open longer hours, even if the day part was not profitable, created unique pressure to operate all hours and drove labor costs higher.

Meanwhile, Blackbox Intelligence reports the number of vacancies in the industry has been on a downward trend since its peak in March 2022. The same report cites that the year-over-year increase in restaurant hourly wages 2023 is predicted to be much lower than in the prior year.

Today’s operator is looking at paring hours as a necessary solution to a workforce staffing crisis. The unexpected payoff, aside from the bottom line, is a better quality of life for the industry. For those buying restaurants, this may attract candidates to the industry who may have previously had concerns over long hours. Staffing needs are also being pared back with the new focus on profitability and savings. 32% of restaurants have cut staffing levels, while 19% postponed plans for new hiring. The other benefit from decreased hours is an offset to rising energy and utility costs, another significant concern for the industry.

These are not the only ways operators are increasing profitability. 21% of operators say they incorporated more technology into their restaurants with franchises leading the way. A recent franchise study conducted by FranConnect found that 61.9% of franchisors are now collecting technology fees, funding their ability to invest in improvements for the brand.

Overall, efforts of restaurant operators may be paying off. The median cash flow reported by BizBuySell was up 13% while median revenue rose 7.8%. That shows more profit for each dollar of revenue generated, indicating improving profit margins for the sector.

Expansion is on Hold

Today, 38% of operators say they have postponed plans for expansion, a finding at odds with pre-pandemic trends. In the five-year period leading up to the pandemic, the compound annual growth rate (CAGR) of restaurants was reported by Rabobank at 2.5%. That resulted in an estimate of roughly 45,000 new restaurants opening over the three-year period, net of any closures. FSR Magazine says it was more than any comparable period over the last 25 years. The pandemic washed out these gains with a loss of restaurants estimated from 70,000 to 80,000 depending on the source.

Between fewer restaurants overall and the pullback on expansion, this will fuel a shrinking count of restaurants available. This should help sellers hold onto pricing levels if they can maintain profitability as the overall supply will be smaller. This is despite survey data showing 47% of business brokers surveyed by BizBuySell feel that today’s market has shifted in favor of buyers, while only 17% feel it still favors sellers. Fewer restaurants available for sale will drive demand and pricing.

Outlook for Restaurant Sales

Gauging the outlook for restaurant transactions in 2023 is tough amidst continued weight on the economy from inflation, interest rate hikes, and fears of recession. In a recent survey of business and academic economists polled by the Wall Street Journal, 61% believe a recession will occur in the next 12 months.

That said, the restaurant industry has already been tested and demonstrated remarkable resiliency. Caught in shutdowns that forced many out of the business and facing immense pressure on all fronts, the business model has adapted in measurable ways to reinvent itself over the past three years.

Buyers have taken note and outpaced the business for sale marketplace overall in acquiring stores. Pressure on new development, along with fewer restaurants overall, should help bolster demand in the short term, even while earnings will likely show diminished results for 2022. The lower earnings will be a precursor to selling prices in 2023, which are liable to slip, since buyers are acquiring on the latest 12-month lookback on performance.

The restaurant for sale marketplace, like the industry itself, may continue to be resistant to some of the market forces as they have already absorbed so many blows.