Quality of Earnings Report: Determining a Business’s Value

A quality of earnings report (QoE or QofE) can help establish a company’s value when selling or buying a business. It can be one of the most crucial steps of any due diligence process.

If you get this wrong or only review the income statement, you may pay a lot for an entity that looks good on paper, yet lacks crucial fundamentals, like sufficient net working capital.

In this article, we’ll explain what you need to know about the quality of earnings report so you can be well-equipped when handling a buy-side transaction.

What Is a Quality of Earnings Report?

A quality of earnings report or quality of earnings analysis analyzes the financial statements of a target company to ensure accuracy, consistency, and sustainability. Also, the QoE report provides buyers with valuable insights into the company’s financial performance using historical earnings to facilitate informed decisions.

It’s important to remember that a quality of earnings report differs from a normal financial audit.

What Is the Difference Between a QoE Report and a Financial Audit/Review?

The key difference between a QoE report and a financial audit is their objectives.

While a financial audit will use GAAP (generally accepted accounting principles) to confirm that the amounts on the company’s financial statements are accurate and generally free from material misstatements, a quality of earnings report is a deep dive into the financial statements and the economics of a business to establish if the figures presented are sustainable.

The fundamental issue is that a target company may report relatively high earnings, yet the quality of the company’s earnings is at rock bottom.

For clarity, high-quality earnings are often sustainable and more closely reflect a company’s free cash flow.

A QoE report can help parties in a transaction identify issues that may not be immediately apparent from the financial statements.

Another key difference between a QoE report and a financial audit is the timing. Financial audits are annual events, while QoE reports are prepared as needed.

At What Stage Is a Quality of Earnings Report Prepared?

A QoE report is often prepared at the start of due diligence.

Typically, a purchase or sale process will start with preliminary negotiations. At this stage, the buyer and seller reach a tentative agreement on the purchase price.

The next step is for the parties to sign a letter of intent. This letter outlines how the purchase will be structured, as well as the initial terms of the purchase, including purchase price, exclusivity period (when the business owner cannot engage other potential buyers), and contingencies.

After the letter of intent, financial and legal due diligence follows. This is when the quality of earnings report is prepared as part of financial due diligence.

Who Should Request a QoE Report?

Typically, the buyer requests a quality of earnings report as part of due diligence.

The buyer wants to know if they’re getting value for their money.

But that said, sellers may also request a QoE report.

A QoE report can help the seller know the true value of their business.

Also, a QoE report can help the seller:

- Identify the add-backs to earnings and negotiate a higher transaction price

- Identify and fix accounting issues, including a realistic working capital target, in advance

- Anticipate the tough questions a buyer would ask

The party who requests the QoE report pays for it.

The cost of a quality of earnings report is anywhere between $10,000 to $100,000 depending on the size of the company, the complexity of the financial structure, and the nature of financial transactions.

Finally, a quality of earnings report is usually prepared by an independent financial services or accounting firm.

Quality of Earnings Example

A QoE report can include many sections and extend to 50 pages. Some sections in the report include background, overview, summary of key findings/areas of concern, quality of earnings report, analysis of financial statements, and appendices.

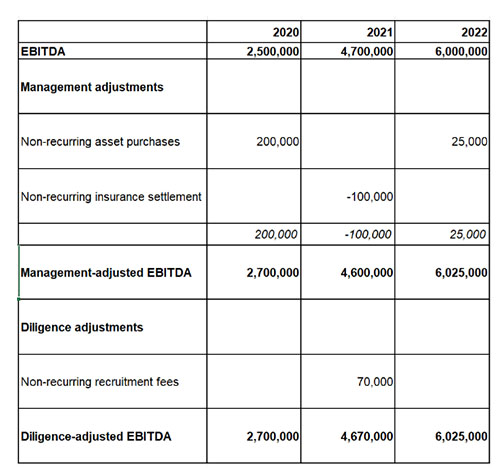

The actual quality of earnings report, however, typically looks like the example below.

Note: EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

As you can see, the adjustments in a QoE report are often meant to account for non-recurring expenses. This is because non-recurring items are unsustainable and may paint an unrealistic financial performance picture.

Also, a quality of earnings report should highlight any revenue concentration with one or few customers and the performance of the different business segments.

Which Documents Are Typically Requested for a QoE Report?

The independent financial services performing the QoE analysis will request financial information and the following documents, among others.

- Monthly financial statements for 3-5 years

- Balance sheets for 3-5 years to determine the company's working capital needs

- Detailed aging information on accounts receivable and accounts payable

- Breakdown of revenue per client/customer

The Takeaway

On the sell-side, a quality of earnings report can help you enter negotiations from a well-informed position. To the buyer, a QoE report is necessary for due diligence.

Here’s the truth: An accurate, realistic valuation is the #1 way to improve your chance of selling. To learn more about how to value a business, visit BizBuySell’s Valuation Learning Center. Or, use the BizWorth calculator to get an estimate of the value of your business instantly.