Restaurant Sales Outpace Small Business Transactions but Trend Slows Amidst Industry Concerns Around Food Costs, Staffing, and Competition

- Restaurant Transactions Grew 5.4% Over the Prior Quarter while the Overall Business for Sale Market Increased 4.8%

- Restaurant Transactions Grew 3.2% over Last Year While Business Sales Declined 10%

- Closed Restaurant Transactions fell to 3.2% following 6.3% Gains in Fourth Quarter

- Sale Prices declined 8% After Trending Up Each Quarter of 2022 over the Prior Year

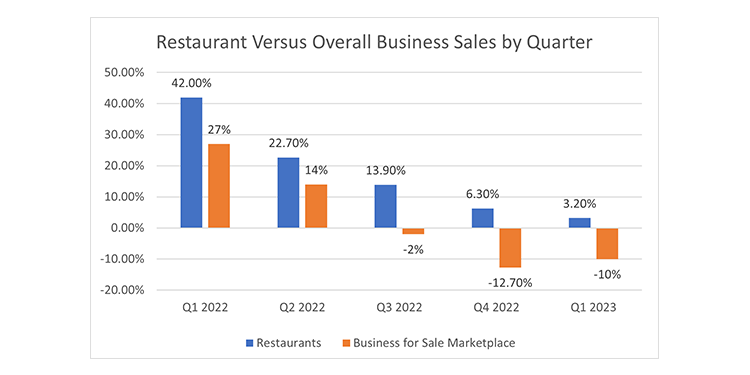

After eight consecutive quarters of growth where restaurant sales outpaced the business for sale marketplace overall, the trend for the industry is slowing. Transactions in the first quarter of 2023 outpaced last year by 3.2% while the overall business for sale market was down 10% for the same period. On a comparison to last quarter however, there was flattening in the trend with restaurant sales ahead of fourth quarter by 5.4% with overall business sales roughly the same at 4.8% growth.

Viewed quarterly, the velocity of restaurant transactions compared to the prior year continues to lag, signaling a slowdown in the hospitality sales market overall. The findings are based on transaction data published by BizBuySell’s Quarterly Insight Report, a nationally recognized economic indicator that tracks the health of the U.S. small business economy.

The chart below shows data for the last five quarters, compared to the overall business for sale marketplace. In the first quarter of 2023, restaurants sold are 3.2 percent ahead of last year. However, the increase to last year is nearly halving on each comparative quarter basis to the prior year. In first quarter 2022, restaurant transactions were 42% ahead of 2021. By second quarter, restaurant sales dropped to 22.7% ahead of last year, before sliding to 12.9% ahead in third quarter. By fourth quarter, restaurant sales were 6.2% ahead, before halving yet again in Q1 to 3.2% increases. While overall, this still shows a performance ahead of the general business for sale marketplace, the trend demonstrates weakening in the market.

Restaurant Selling Prices Dip

Restaurant selling prices fell at a rate of 8% from $225,000 down to $207,000 in the first year-over-year decline since the first quarter of 2021. Median asking prices fell at the same rate, down 8 percent over last year and last quarter. Taken together, these findings indicate that brokers are listing units at lower prices and the market is responding with lesser negotiated selling prices. Restaurants sold on average at 90% of selling price, equal to the first quarter of 2022 but below second quarter (92%), third quarter (94%) and fourth quarter (93%). This shows some weakening in both asking and selling prices for restaurants.

Restaurant owners may have delayed selling their restaurant since they were simply caught in the trap of operations and unable to focus on listing their restaurants for sale. This correlates to BizBuySell small business owner survey data that says, “nearly a third (28%) of business owners say they are speeding up their exit timelines. While 44% say retirement is motivating them to sell, 30% say they are burned out and 21% point to economic uncertainty.”

The recently released 2023 State of the Restaurant Industry Report projects the hospitality workforce to grow by 500,000 jobs this year, leading to total employment of 15.5M by the end of the year, higher than pre-pandemic levels. This is welcome news as staffing was a key issue for many restaurant owners. Nearly two-thirds (62%) reported they were understaffed in 2022. That may be easing as the “Great Resignation” seems to have finally ended. A recent survey by Paychex found that 80% of those that left their jobs in 2021 now regret the decision. A stunning 68% of those that left a role have tried to get their job back. That is good news for restaurant operators who have struggled with staffing since the pandemic.

Competition is also on the minds of operators. The 2023 State of the Restaurant Industry Report also found that “47% of operators expect competition to be more intense than last year.” The final count on restaurant closings by the National Restaurant Association indicates that 90,000 restaurants closed on either a permanent or long-term basis due to the pandemic.

Median Revenue Up as Cash Flow for Restaurants Sold is Lower

Median revenue for restaurants sold was $727,311, a 1% gain over last year and 12% gain over the prior quarter. This is partially a function of continued increases in menu pricing as restaurants work to overcome the impact of inflation on the business model. National Restaurant Association economists predict foodservice industry sales to reach $997 billion in 2023, driven in part, they say, by “higher menu prices.”

The Bureau of Labor Statistics supports the higher menu pricing findings, pegging inflation for meals away from home for April 2023 on a twelve month basis at 8.6% versus 7.1% for food prepared at home.

The median cash flow of restaurants declined in the same period, from $132,846 in the prior year’s first quarter to $120,000 in 2023’s first quarter. This 10% decline in median cash flow and overall gap in cash flow despite increased sales, is the impact of inflationary pressures on all costs for restaurant operators, resulting in smaller operating margins. Recently, 92% of restaurant operations cited higher food costs as a “significant challenge.”

Regional Restaurant Sales

While overall restaurant sales were positive to last year and last quarter, results varied by region. The Mountain states, (AZ, CO, ID, MT, NM, NV, UT, WY) were collectively down 12% to last quarter and down 20% to last year, indicating this was the most challenging region of the country in this quarter. However, the comparison to last year, is against a remarkable 2022 performance for these states where transactions outpaced even 2019 pre-pandemic numbers.

Midwestern states (IA, IL, IN, KS, MI, MN, MO, ND, NE, OH, ND,SD, WI) had a mixed performance, trending down 2% from last year, but far outpacing last quarter with a 19% gain. The Northeastern states (CT, MA, ME, NH, NJ, NY, PA, RI, VT), also showed varied results, with transactions up 4% over last year, but down 3% from the previous quarter.

Two regions in the country were ahead of both latest quarter and last year. The Pacific region (AK, CA, HI, OR, WA) trended up 10% to last year’s same quarter and beat fourth quarter by 1 percent. The Southern states, (AL, AR, DC, DE, FL, GA, KY, LA, MD, MS, NC, OK, SC, TN, TX, VA, WV), were the strongest overall, trending up 11% in transactions to last year and increasing 8% over fourth quarter. Remarkably, these same southern states have turned in consistent double-digit increases over the prior year for the last eight consecutive quarters and show no sign of slowing down.

Overall, despite seven consecutive quarters of growth, national restaurant sales have still not returned to the level of transactions reported in 2019 prior to the pandemic, except for the Mountain states. This indicates some sellers are still waiting on market recovery to enter the business for sale arena. Owners may be signaling that this wait is over, however. After years of turmoil in the restaurant industry, sparked by the pandemic, the National Restaurant Association latest 2023 State of the Restaurant Industry Report, reports that “Nearly 3 in 4 operators say business conditions are already close to normal—a new, more positive normal—or are well on the path, and the focus is on sustaining growth in the coming year.”

Median Days on Market Increases for Restaurants

The median days on market grew to 174 versus last quarter’s measure of 162 days but still sharply lower than last year’s 191 days. This is good news for restaurant owners looking to exit the business and indicates inventory is turning over at a faster rate.

Where Will the Restaurant for Sale Marketplace Trend?

As 75% of restaurant owners embrace their “new normal,” business brokers could see less reluctance to list and sell restaurants while waiting for better or “more normal” business conditions to return. Small business owners seem to show the sentiment that business overall is improving. In one study, IOU Financial, an online lender to small businesses, found that 88% of small business owners have a positive outlook for 2023. A data point confirming the ability to pay their bills and rent delinquency, also improved for small business owners from December to January.

Restaurant sales overall are growing and support the National Restaurant Association projections for increases this year. The U.S. Census data for the first four months of 2023, show sales at food service and drinking places 14.5% ahead of 2022. That number far exceeds the retail and food services overall total, which was up 3.8%. Specific segments like clothing and clothing accessory trended at only .9% for the same period and general merchandise stores including department stores and supercenters were up just 5.5%.

Overall increases in restaurant sales buffers operators from the cost increases leeching operating profit from their financial statements. Buyers and business brokers may anticipate stronger 2023 financial results as operators maintain higher menu prices and contain rising food costs, both measures that improve profitability.

Concerns around a looming recession continue for buyers and sellers. This has played out in the industry in a “trade down” among service models that continues to benefit QSR or the quick service restaurant model. Customers on a limited budget, continue to allocate part of the family budget to dining away from home, but trade more expensive concepts for economical alternatives. QSR restaurants reported a 3% increase in traffic in February while more expensive, full-service concepts declined.

Overall, consumers are reluctant to forego the dining experience despite financial challenges and enjoy restaurants as a fundamental part of their leisure activities. Consumers recently surveyed by the National Restaurant Association said that, “84% of consumers say going out to a restaurant with family and friends is a better use of their leisure time than cooking and cleaning up.”

Seller financing will continue to be critical as banks tighten their credit box and some shy away from the restaurant model. Restaurant owners should anticipate a request for partial seller carry on their businesses. However, seeing sales increase, the labor market easing and costs under control, may provide more comfort to sellers in holding notes as they view the industry realignment as the standard versus a transitory model.

Meanwhile, the appetite for acquisition, despite challenges, continues unabated. BizBuySell reported the number of monthly visits by buyers up 27% over the previous year on their platform. We Sell Restaurants, featuring only restaurant for sale listings, reported 20% traffic increases for the same period.

The positives for the market overall include rising sales, a committed consumer, and relief on hiring. Restaurant opportunities may increase as operators previously on the sidelines enter the market. Plans to exit that were forestalled first by the pandemic, and then the onslaught of inflation, hiring woes and a supply chain crunch, may be back in play as sellers view the current landscape as their “new normal.”

Factors contributing to a slowdown in units include the interest rate impact on lending and concerns over a pending recession. Buyers may have the upper hand in negotiating the best terms under market conditions. However, despite all the challenges it has faced, restaurant sales have still outperformed the general business for sale market for the last five quarters, demonstrating remarkable resiliency as an industry.