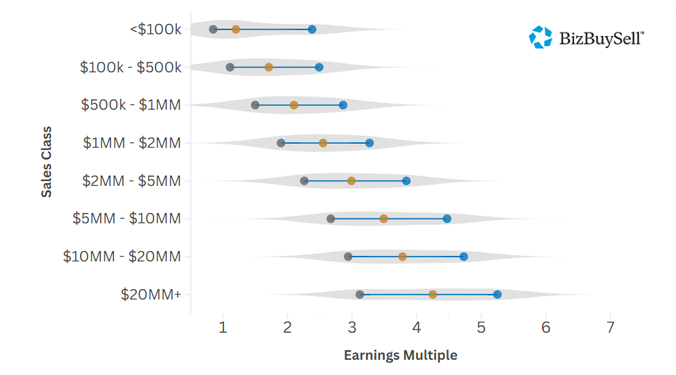

How Business Size Drives Up Valuation Multiples

There are many factors that influence the price at which a business will ultimately sell for. From ease of operation and level of owner involvement to its competitive advantages, the industry's barriers to entry, and its historical performance. Easy to operate businesses with a big "moat" and years of consistent earnings will sell for a higher multiple, while younger, easily replicated owner-operated businesses will sell for a lower multiple. However, across every business industry and in every market, one of the single most influential drivers of valuation multiples is business size. The bigger the business, the greater the multiple it will sell for.

| Earnings Multiples by Sales Class | ||||||

| Sales Class | 10th %ile | 25th %ile | Median | Average | 75th %ile | 90th %ile |

| <$100k | 0.70 | 0.85 | 1.20 | 3.04 | 2.38 | 4.62 |

| $100k - $500k | 0.76 | 1.11 | 1.71 | 2.53 | 2.49 | 3.63 |

| $500k - $1MM | 1.02 | 1.50 | 2.10 | 2.66 | 2.86 | 3.94 |

| $1MM - $2MM | 1.34 | 1.90 | 2.55 | 3.09 | 3.27 | 4.31 |

| $2MM - $5MM | 1.67 | 2.26 | 2.99 | 3.38 | 3.84 | 5.00 |

| $5MM - $10MM | 2.05 | 2.67 | 3.49 | 4.21 | 4.47 | 5.88 |

| $10MM - $20MM | 2.14 | 2.94 | 3.78 | 4.63 | 4.73 | 5.79 |

| <$20MM | 2.49 | 3.12 | 4.25 | 4.63 | 5.25 | 6.62 |

| Sales classes and earnings multiples derived from reported annual revenue, annual sellers discretionary earnings, and sale price of businesses sold on BizBuySell in the five-year period from 2020 through 2024. | ||||||

Why Bigger Businesses Get Bigger Multiples

There are several reasons bigger businesses are valued at bigger premiums. One of the main drivers has to do with risk. Larger companies are often seen as more stable and less likely to suffer a financial impact from a transition in ownership. They tend to have a larger and more diversified customer base, more consistent revenue streams, and larger employee base that is more likely to stay and keep operations running smoothly through an ownership transition.

Reduced risk is certainly a driver of premium valuations on bigger businesses, but there is another factor that moves the multiple needle up for larger business acquisitions, and that is the economics of acquisition financing.

How Leverage Affects Small Business Sale Prices

Almost every small business acquisition will involve some kind of financing. Buyers typically bring around 10 - 20% of the purchase price in cash and then finance the remainder – either with an SBA loan, seller financing, or a combination of both. The leverage ratio, the proportion of borrowed money compared to the buyer’s down payment, is a key factor in business acquisition economics. This allows business buyers to “leverage” their own capital five to ten times.

Leverage

Leverage allows buyers to purchase larger businesses than they would otherwise be able to afford, which means they can acquire a larger income stream. At the same time, they also pick up an obligation to service the debt. In very simple terms, the difference between the debt service (principle + interest payment) and the business income is what the new owner may put in his or her pocket. The ratio of the business income to the debt service is called the debt-service coverage ratio (DSCR). Lenders look for a DSCR of around 1.25 or higher, meaning the business generates $1.25 of income for every $1.00 of debt service.

Buying Greater Income

The interesting outcome of all this math, is that business buyers can leverage debt to buy themselves more income, even at higher valuations. Let’s use a simple example to see how it works out:

Adam, a machinist, has saved $200,000 to buy a business and needs to earn $100,000 annually to maintain his lifestyle. He has two options available:

- A machine shop with annual revenue of $1,000,000, owner earnings of $200,000, and an asking price of $600,000, or

- A machine shop with annual revenue of $2,000,000, owner earnings of $400,000, and an asking price of $1,400,000.

The first machine shop is looking for a 3x earnings multiple, while the second machine shop is expecting 3.5x.

Option 1:

- Purchase price $600,000

- Down Payment: $200,000

- SBA Loan: $400,000

- Annualized debt service (@12% for 10 Years): $69,000

- Annual Owner Earnings: $200,000

- Earnings after debt service: $131,000

Option 2:

- Purchase price $1,400,000

- Down Payment: $200,000

- SBA Loan: $1,200,000

- Annualized debt service (@12% for 10 Years): $207,000

- Annual Owner Earnings: $400,000

- Earnings after debt service: $193,000

In Adam’s case, as in most, the greater the leverage used in a business acquisition, the greater the potential income. This is simply a function of the interest rates generally being much lower than the rate of return on the typical business acquisition.

Cash on Cash Returns

The cash-on-cash return, also known as cash yield, is a common metric in the business for sale and commercial real estate markets. It’s used to determine whether a particular investment is worth pursuing. It’s calculated by dividing the down payment in a transaction (whether commercial real estate, or a business acquisition) by the expected pre-tax owner discretionary earnings after debt service. From the two examples above, we can calculate the cash-on-cash returns as follows:

Option 1: $131,000/$200,000 = 66%

Option 2: $193,000/$200,000 =97%

By utilizing financing leverage to purchase the bigger business, Adam increases the expected return on his $200,000 investment, even when paying the higher valuation multiple. Along with the lower perceived risk mentioned above, this business acquisition financing system is a big factor driving valuation multiples of larger businesses up. As the business grows, there is simply more money to go around and cover both financing costs and owner income.

Greater Leverage Adds Risk

Of course, with this greater income comes additional risk. Should the business turn south, for whatever reason, the new owner is potentially on the hook for a much larger amount of money. Every business acquisition analysis should account for increased risk, and thorough due diligence is critical to protect buyers from unexpected business declines. New and inexperienced business buyers would do well to consult with an experienced business broker, or M&A consultant, when considering making a leveraged business purchase.