Your Exit Planning Timeline: A Roadmap to Selling Your Business

Selling a business takes time. Most successful exits start years before being listed. Business exit planning gives owners time to shift from running the company to preparing it for someone else to take over.

Big changes happen during this shift; after all, buyers want systems, not just your time and effort. A longer exit plan lets you strengthen operations, tidy finances, and create lasting value. The more transferable your business is, the easier it is to sell, and the more it's worth.

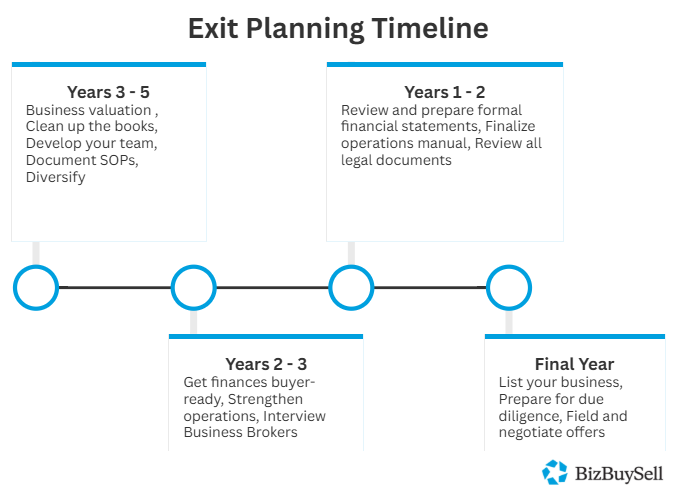

Years 3-5 Out

If you're 3 to 5 years away from selling, now is the time to lay the groundwork and get your business ready to sell. This early stage considers structure, not just sales. The goal is to create a business someone else wants to buy, whether it's family members or private equity firms. Having an exit mindset will help you stay focused.

If you have 5+ years, focus on:

- Business valuation. Establish a baseline to track improvements and set financial goals.

- Clean up the books. Shift to accrual accounting and improve bookkeeping systems.

- Develop your team. Train key employees to take over daily roles.

- Document how things work. Create standard operating procedures (SOPs) and manuals to help future business owners.

- Diversify. Avoid relying too heavily on a few major clients or suppliers. A small business that puts all its eggs in one basket, so to speak, doesn't appeal to strategic buyers.

If you're starting with 3 years, there's still time to make changes to increase the value of your business:

- Financial statement cleanup. Align your P&L with tax returns to avoid red flags. A financial advisor or estate planning consultant can help.

- Key person assessment. Identify knowledge gaps that could hurt a sale or affect business continuity.

- Market position analysis. Know your competitors and highlight what sets your business apart.

Years 2-3 Out

With 2–3 years to go, shift to making the business more attractive on paper and reduce owner dependency so it can run without you. This is when many of the improvements start taking shape and business value becomes visible to buyers.

Getting finances buyer-ready is a top priority.

- Recast your financials to show Seller's Discretionary Earnings (SDE) so buyers see the true earning power of the business.

- Review and cut non-essential spending to improve profit margins.

- Build predictable income by focusing on steady, recurring revenue sources.

- Manage debt. Pay down loans and avoid making obligations that could worry a buyer (or the next generation, if it's a family business).

Strengthen operations to reduce your involvement.

- Build a reliable management team to handle day-to-day tasks.

- Create systems that make the business easier to run and transfer.

- Upgrade outdated technology to modern platforms that buyers expect.

- Secure and document vendor relationships to maintain supply stability after the business sale.

Fine-tune your market position so your business stands out.

- Do a competitive analysis to address gaps and highlight your advantages.

- Strengthen your brand and protect digital assets and intellectual property that add value.

- Improve customer retention through loyalty or subscription programs that support recurring revenue.

Finally, begin researching how you'll sell. Interview business brokers to get insight into modern day entrepreneurs. Learn about mergers and buyouts. Understand liquidation, and when it comes into play during succession planning. You should also research what documents and information are required for selling a business. Once you decide on an exit strategy, then the exit planning process can start.

Year 1-2 Out

With 1–2 years before selling, the focus shifts to cleanup, organization, and final steps that prepare the business for a smooth transition. This stage is about reducing buyer friction and highlighting a business's value.

Start by getting your paperwork in order:

- Have your exit planning advisor and CPA review and prepare formal financial statements that stakeholders can trust.

- Work with professional advisors to understand tax liabilities.

- Review all legal documents—leases, licenses, and contracts—to make sure they're transferable.

- Update employee files, including job descriptions, pay structures, and non-compete agreements. Plan for any potential management buyouts.

- Finalize your operations manual so the successful business can run without daily input.

- Set up a digital data room to securely share documents during buyer due diligence.

To boost your company's value, finish any major projects already underway. Lackluster real estate and outdated systems can hold back a sale. Evaluate market conditions to plan timing the sale of your business. Decide if you'll get professional help or sell your business without a broker. It can vary based on the type of exit. Line up your team and update the value of the business to see how improvements have affected your asking price.

Lastly, get buyer-ready by putting a clear management transition plan in place. Show that the business can run without you. Highlight growth opportunities for new owners. Prepare at least three years of clean financials that back up your numbers and build buyer trust.

Final Year

In the final year before the sale, the focus shifts to execution. Everything you've prepared now supports the actual sale process.

- Pre-listing, starting with a final valuation to set a realistic sale price. Create a short business summary for your listing and draft a Confidential Information Memorandum (CIM) for serious, qualified buyers. Plan how you'll protect confidentiality to avoid disruption to staff, customers, and vendors. Identify the different buyer types and define your ideal buyer. Set financial requirements so you can quickly determine whether a buyer is qualified.

- During the selling process, work with your broker or list your business for sale online through platforms like BizBuySell. Respond to inquiries and take time to screen potential buyers. Focus on those who match your criteria and are financially prepared.

- Prepare for due diligence by organizing all required documents, including financials, legal agreements, employee info, and operational details.

- As offers come in, negotiate terms with help from your accountant, attorney, and broker. Their guidance in decision-making can streamline last-minute issues.

For more exit planning resources, visit BizBuySell's Learning Center to learn about how to sell and value your business. Download our Guide to Selling Your Business to access a comprehensive digital toolkit to help you plan your exit.