The First 100 Days of Trump’s Second Term: Small Business Sentiment Amid Uncertainty

With the S&P 500 flirting with bear-market territory and the dollar approaching a four-year low, small business owners are navigating a climate filled with economic uncertainty. Adding to concerns, U.S. Treasuries are experiencing a selloff, driven in part by rising interest rates and calls from the Federal Reserve to be patient while gauging tariff and policy impacts. For small businesses, these shifts could lead to higher borrowing costs and increased pressure on cash flow as inflation and financing challenges spread throughout the economy.

To better understand how these factors are influencing business sentiment, BizBuySell’s quarterly Insight Report surveyed business owners, prospective buyers, and business brokers on the impact of the administration’s first 100 days. Approaching the April 29 milestone, the small business community reflects a blend of concern, cautious optimism, and a distinct sense of waiting to see how evolving policies will shape their future.

Small Business Owner Sentiment on Trump Administration Policies

According to the Insight Report survey, business owners are divided on how the new administration’s policies have affected their outlook, with roughly equal portions reporting improved, unchanged, worsened, or uncertain perspectives.

Among those expressing optimism, many point to policies aimed at promoting domestic production and reducing foreign competition as potential long-term advantages. "I am hopeful that policy changes will push foreign competitors out of the market and improve sales for my business," one respondent noted. Jonathan Purgason of Skyline Realty added, "The tariffs may hurt us short term, but long term will keep us on track for more prosperity."

On the other hand, however, many business owners point to economic uncertainty and rising costs as challenges. "After 5 years of rapid growth, the Trump tariffs brought my business to a screeching halt. This is the first time I have had year-over-year decline in revenue for the past few months," one owner shared. The sentiment of uncertainty echoes through many responses. Orlando Dorsey of Business Valuation Service offered: "The uncertainty has everyone on the fence right now. Decisions are hard to come by."

Policy Priorities for Small Business Owners

When asked about policy priorities, addressing inflation topped the list for business owners, followed closely by tax reform. Actions aimed at eliminating waste, fraud, and abuse in government, as well as reducing regulatory burdens, also ranked high on the list of concerns.

Some respondents expressed optimism about the administration’s DOGE initiatives targeting waste and inefficiency. "Actions aimed at eliminating waste, fraud, and abuse will enable the government to operate more efficiently and allocate funds in ways that deliver greater value to American taxpayers," remarked John Zentmeyer of Know Idea, LLC.

While some respondents expressed optimism about the administration’s initiatives, others voiced skepticism about their effectiveness. "The new administration is doing its best to drive small businesses out of business in favor of large corporate donors," one respondent claimed. This perspective echoes the sentiment of nearly one-fifth of surveyed participants who believe that none of the administration's policies will positively impact their business.

Business Broker Perspective

Business brokers surveyed by BizBuySell acknowledge the economic uncertainty created stemming from Trump’s second term. When asked about their top concerns for the remainder of 2025, they overwhelmingly pointed to a potential recession, reflecting the economic policies and financial uncertainty of the current climate. Rising interest rates and the ongoing effects of tariffs were also cited as challenges for the year ahead.

"Tariff announcements are adding uncertainty to the business-for-sale market, particularly in industries reliant on international supply chains, such as manufacturing and retail," one broker explained. Max Friar, of Calder Capital, added, "Tariff announcements will continue to be a moving target throughout the year, which will sow deeper uncertainty and delay or void capital and business investment."

Charles Patawaran, of Gatsby Advisors Brokerage, highlighted how "high interest rates significantly impact the business-for-sale market by increasing borrowing costs, which can deter potential buyers and lead to lower business valuations."

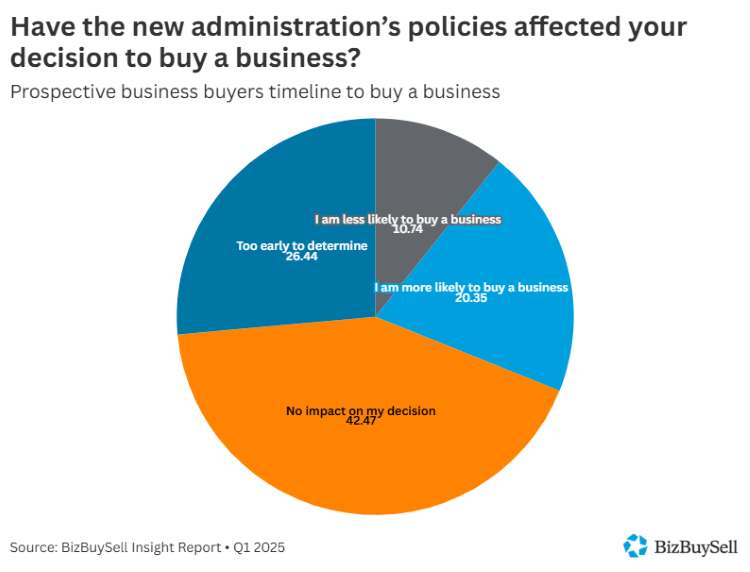

First 100 Days and the Impact on Business Buyers

The first 100 days of the new administration have prompted mixed reactions from prospective business buyers, with responses reflecting a blend of uncertainty, cautious optimism, and strategic hesitation. A large portion of buyers indicated that the administration’s policies have had little to no impact on their decision to purchase a business. "Recession-resistant businesses will likely become more important in my planning, but I am not more or less motivated to purchase a business," explained one buyer.

Others, however, are adopting a more careful "wait and see" approach. "With economic uncertainty, it's definitely made me pause multiple times and consider if I should wait," shared a prospective buyer wary of the current economic climate.

On the flip side, some buyers remain optimistic about the future of small businesses, which has fueled their interest in moving forward with a purchase. "I've been interested for a long while, but I believe the future will be better for small business than it has in the past," noted entrepreneur.

Meanwhile, a number of prospective buyers are hesitant, citing concerns about economic instability and the risk of stagflation. "Was very keen to buy until I saw the tariffs and other policy changes, which risk stagflation—puts me as a small investor on the sidelines," explained one potential buyer.

Industry-Specific Impact from New Policies

The impact of the new administration's policies varies widely across industries, with certain challenges standing out for specific sectors. Survey respondents in the real estate industry stress the importance of interest rates, with many advocating for rate reductions to spur market growth. Meanwhile, those in the retail and hospitality sectors point to inflation and tariffs as important issues driving up operational costs and limiting consumer spending.

Across all sectors, small business owners report feeling vulnerable to the economic challenges posed by the new administration’s policies. "The harder it is for consumers to find disposable income, the harder it will be for my company," one business owner remarked. Another added, "I'm trying to keep an open mind, remembering that all small businesses are dealing with the same conditions. I worry that the winners will continue to be large corporations, which will keep cannibalizing smaller companies."

While the opening months of the new administration have sparked both optimism and concern, the overriding theme among business owners is uncertainty. Many are taking a "wait and see" approach as they assess how new policies might influence their operations and growth strategies. One business owner summarized the general mood succinctly: "I believe we should all take the time to observe our surroundings, but let's not hesitate to keep pushing forward."

For more about how business owners, brokers, and prospective buyers are navigating the current economic climate and its impact on the business-for-sale marketplace, read BizBuySell’s quarterly Insight Report.