The Impact of Tipping Culture on Small Business Valuation

Small business owners, especially those in the service industry, are discovering that tipping is an effective tactic to navigate the challenging labor market. Businesses, faced with inflation and higher minimum wages, are looking for strategies that both attract and keep employees without compromising profitability. While tipping becomes increasingly prevalent in society, its political and economic consequences remain uncertain.

Tipping as a Response to Labor Challenges

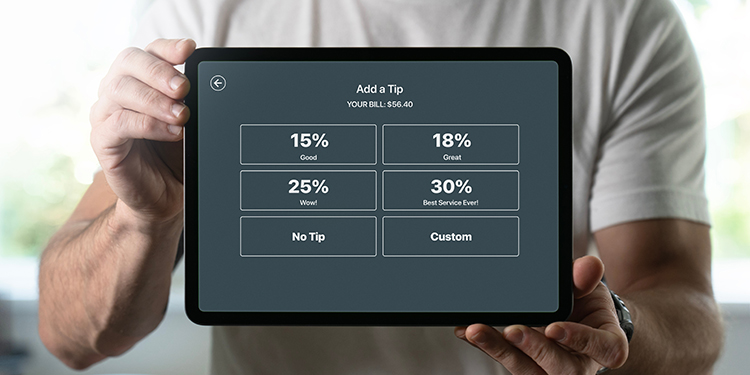

According to the latest BizBuySell Insight Report, which tracks the health of the business-for-sale marketplace, almost half (47.61%) of business owners report no improvement in the labor market, which is a slight increase from late 2023. For many, tipping has emerged as a solution. The New York Times reports that businesses with established tipping practices are more appealing to job seekers, as tips boost overall earnings. This trend makes it harder for businesses to scale back tipping. The ease and convenience of current tipping technology, which gained popularity during the pandemic, continues to win over workers and customers.

Customer Spending and Tipping Trends

While tipping can show appreciation, it’s also putting financial pressure on customers. Some business owners are reporting to BizBuySell that they’re seeing a decrease in tips as customers cut back due to inflation and economic uncertainty. With this shift, businesses are effectively passing the responsibility of wage growth from onto their customers.

Implications for Business Valuation and Sales

These tipping trends impact small business valuation and sales. Relying heavily on tips can hide the real operational expenses of doing business, which may lead to an inaccurate business valuation. When it comes to selling a service or restaurant business, accurately reporting tip income is important in presenting an honest picture of business performance to potential buyers. Although tipping can enhance staff retention and make a business more attractive to buyers, owners must carefully consider the potential negative impact on customer perceptions, which could ultimately impact long-term value.

Future Considerations

With the evolving tipping culture, small businesses must consider several factors that could impact their operations and valuations. Presidential candidates from both parties are proposing policy plans to abolish taxes on tips, which could further encourage tipping. However, economists caution that these popular initiatives may prove inadequate in terms of fairness, efficiency, and generating income. They express concerns about the potential administrative hurdles and financial losses that may arise over time, as well as the vulnerability of tipping practices during economic downturns.

For small business owners considering buying, selling, or valuing a business, understanding tipping’s role in today’s labor market is essential. Although tipping can provide temporary relief from wage pressures, it’s important to evaluate its lasting effects on business operations, customer satisfaction, and overall value. Navigating these challenges successfully will require adaptability and staying informed as the landscape continues to change.