Small Business Owner Sentiment in 2024

As 2024 is in the rear-view mirror, the small business landscape remains resilient. As the backbone of the economy with 33 million businesses employing 61 million Americans, small businesses are uniquely positioned to gauge economic conditions and policy impacts. The U.S. economy's soft landing in 2024 brought 2.8% growth and stabilized inflation from 3.1% to 2.9%, prompting three Federal Reserve interest rate cuts in March, July, and November as inflation approached their 2% target. These cuts, totaling 75 basis points, provided some relief to business owners facing high borrowing costs. While small business owners predicted an optimistic 2024 in BizBuySell's Insight Report at the end of 2023, the reality proved more challenging than anticipated, tempering those early expectations.

2024: Early Optimism Meets Market Reality

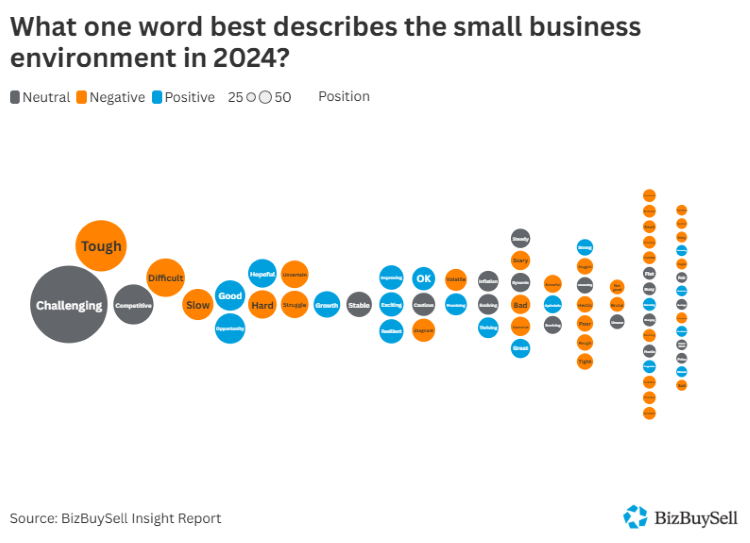

BizBuySell's Insight Report, which tracks the health of the U.S. small business economy, surveyed over 2,000 business owners to capture their experience running, operating and selling a business in the current economic climate. When asked at the end of 2023 to describe their outlook for 2024 in one word, over half of respondents expressed positive sentiment. The predominant responses included hopeful, optimism, growth, and better. As 2024 got underway, business owners faced persistent challenges that echoed their 2023 experience.

Sentiment shifted dramatically between Q4 2023 and Q4 2024. Mentions of 'hope' dropped sharply from 128 to 16, while 'optimism' fell from 119 to just 7. Conversely, references to 'challenging' climbed from 42 to 106, and 'tough' increased from 13 to 48. Over 77% of business owners reported increased expenses, with cost of goods being the biggest factor (69.9%), followed by insurance costs (50.7%), marketing expenses (44.2%), payroll (43.7%), and fuel and energy costs (43%). With just over 50% reporting no improvement in the labor market or ability to hire and retain employees at reasonable rates, owners are eager to see how new administration policies might affect their bottom lines.

2024: A Market in Transition

The landscape of seller sentiment in 2024 reveals a market in transition. While challenges persist for 38.9% of sellers, an equal portion report neutral sentiment, and 22.2% express positivity - suggesting a market finding its footing. Key descriptors have evolved to include ‘good’ and ‘opportunity’ (each 18 mentions) though ‘challenging’ (106), tough (48), and competitive (30) remain significant constraints.

2025: Opportunities Emerges

Looking ahead to 2025, seller sentiment shows unprecedented optimism, with 42.9% expressing positive outlook - a marked shift from the previous year. Common descriptors have transformed from "challenging" to "hope," "optimistic," and "growth." However, this optimism appears more measured than the enthusiastic predictions that preceded 2024, reflecting hard-earned wisdom from recent experiences.

The Road Ahead

As 2024 ends, small business sentiment reflects both market realities and adaptation. With 42.9% of owners expressing optimism for 2025 - up from 22.2% positive sentiment in 2024 - the market shows signs of stabilization. Small businesses that weathered 2024's rising costs and labor challenges emerge with tested operational strategies. This evolution from survival to stability suggests improved conditions for business transitions. For sellers evaluating their timing, current market dynamics, including aligned buyer expectations and proven business resilience, may present strategic opportunities in 2025.