Small Business Owners Weigh In on Interest Rates and Business Valuation

All eyes were on Jackson Hole today as Federal Reserve Chair Jerome Powell addressed how the Fed is weighing the current economic landscape in anticipation of the next Federal Reserve meeting in September. His remarks signaled that interest rate cuts may be on the horizon, citing a “shifting balance of risks” driven by a softening labor market and restrained inflation. While Powell stopped short of calling for a rate cut, the message was clear: the fed is preparing to ease borrowing costs if economic conditions continue to decline. For small business owners, these signals are more than just macroeconomic noise — they directly influence decisions about growth, investment, and exit strategies.

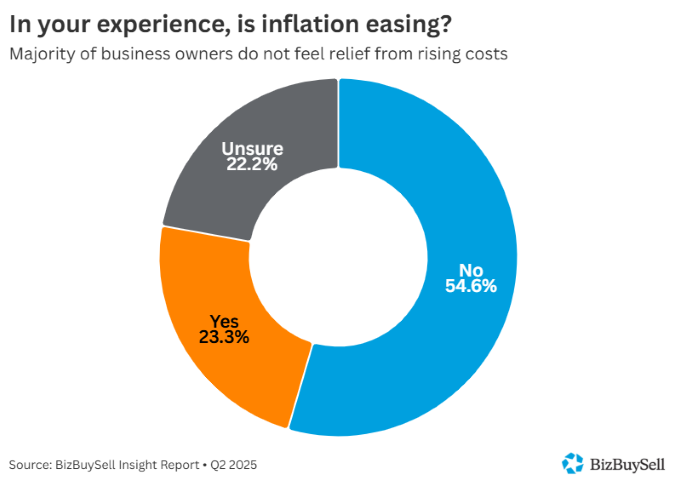

Inflation Concerns Remain High

For BizBuySell’s most recent Insight Report, which tracks the health of the small business for sale market, 54.6% business owners surveyed said they do not believe inflation is easing. Rising costs are still hitting their bottom line, making it hard to plan, invest, or grow.

Expansion Plans on Hold

BizBuySell asked whether owners are postponing expansion plans until interest rates decrease. 40.3% said yes, while 59.7% said no. While a majority are pushing forward, a significant portion are holding back — waiting for more favorable borrowing conditions before committing to growth.

Interest Rates Are Affecting Business Valuations

Business owners were also asked how today’s higher interest rates are impacting what a buyer would pay for their business. The majority believe the effect is negative: over half said interest rates are decreasing their business valuation, with 16.89% reporting a significant decrease and 34.86% noting a moderate one. Meanwhile, 27.57% said interest rates have had no impact, and a small minority — just over 5% — believe rates are actually increasing their valuation. Notably, 14.73% of respondents were unsure, highlighting the uncertainty many owners feel in today’s economic climate.

Looking Ahead

If the Fed moves forward with rate cuts in September, it may offer some relief for Main Street. Powell emphasized that any adjustments will be modest, as the Fed aims for a “neutral” policy stance that neither accelerates nor slows the economy. Small business owners are navigating a complex environment where inflation, interest rates, and policy shifts are all playing a role in shaping their decisions.