How New SBA Loan Rules Are Reshaping Seller Financing in Business-for-Sale Deals

As of June 1, recent SBA loan policy updates may already be influencing how small business transactions are structured – especially when it comes to seller financing. Under the new rules, sellers who offer financing may now be required to personally guarantee the loan, depending on the terms. That added risk could make some owner more hesitant to offer financing, even though it’s long been a key tool for attracting serious buyers and closing deals.

Traditionally, sellers offer financing for a portion of the deal – anywhere from 10% to a third or more – to help close transactions and attract qualified buyers. While this means accepting less cash up front, it can still support a smoother exit, especially for owners looking to retire or move onto their next acquisition. For serial entrepreneurs, even a partial cash-out can provide the liquidity needed to fund their next move.

Buyers, on the other hand, often view seller financing as a sign of confidence. It signals that the seller believes in the business’s future and is willing to stay involved during the transition. It also make financing more accessible, especially in today’s high-interest environment.

Yet many sellers may not be aware of how the rules have changed. Over 50% of business sellers surveyed in the Q2 2025 Insight Report are unaware of recent SBA loan policy changes. Understanding the new SBA SOPs is essential for structuring deals that close smoothly and meet today’s new lending standards.

SBA Loan Policy Updates

New SBA loan rules that took effect June 1, 2025, are already reshaping how small business deals are structured – especially when seller financing is involved.

"SBA lending has become a real challenge with new federal regulations regarding seller notes to be on full standby," said business broker Mark Kincannon of Resolution Equity Partners.

Under the updates SOPs, sellers who retain partial ownership and offer seller financing must now personally guarantee the loan. The length of that guarantee depends on the size of the seller note:

- For seller notes under 20%, the seller must guarantee the loan for two years

- For seller notes over 20%, the guarantee extends for the full life of the loan – often 10 years or more

The SBA also tightened up equity injection requirements. Buyers must now contribute a minimum of 10% down, and only half of that –5%-- can be financed by the seller. If a seller note is used to cover that 5%, the seller must be on full standby for the life of the loan.

Sellers can still remain involved post-sale in a consulting capacity for up to 12 months. However, these roles must be clearly defined as non-managerial and without decision-making authority to ensure a clean transition to the new owner.

These changes are designed to reduce loan defaults amid rising interest rates and broader economic uncertainty. For seller considering financing as part of their exit strategy, understanding the new SBA rules is essential to structure deals that close smoothly and minimize personal risk.

According to BizBuySell's Q2 2025 Insight Report, 41.3% of business brokers say the SBA loan policy changes are causing delays in closing deals. Meanwhile 36.1% report no impact, and 22.7% are unaware of the changes. These findings highlight how the new rules are already influencing deal timelines and broker workflows.

Seller Financing Trends

Seller financing remains a common component in small business transactions, but new SBA rules and economic headwinds are shifting expectations on both sides of the table.

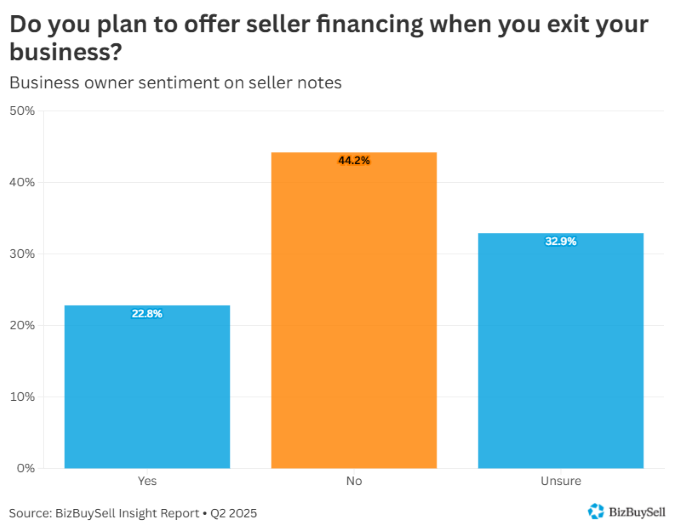

According to the Insight Report, only 22.8% of sellers plan to offer seller financing, while 62.3% of buyers are considering it as part of their acquisition strategy. Despite the SBA’s recent policy changes, 49.2% of buyers and 52.1% of sellers remain unaware of the updates. Just 10.6% of buyers say the changes have impacted their ability to secure financing.

This growing awareness gap is contributing to a widening expectation gap. Sellers often prefer a clean exit, while buyers increasingly expect seller participation—both to ease financing and to ensure a smoother transition. Buyers are looking for 30-40% seller financing, while most sellers remain comfortable in the 10-20% range.

As SBA personal guarantee requirements and equity injection rules tighten, deal structuring is under pressure. Sellers hesitant to finance and buyers facing stricter lending terms are turning to alternatives like conventional loans and search funds. In this environment, working with experienced advisors—business brokers, SBA lenders, accountants, and attorneys—will be key to bridging the gap and closing deals.

Buyer Leverage in the Current Market

Buyers are gaining ground in today’s market. According to the Q2 Insight Report, the sales-to-ask ratio dropped from 95% in Q1 2025 to 92% in Q2 – signaling increased buyer negotiation power. While sellers are listing businesses at higher prices, buyers are holding firm and negotiating with more confidence. Cash flow is up, even as revenue remains flat, suggesting that buyers are prioritizing operational efficiency and strong margins over top-line growth. In a high-interest environment with tighter SBA lending rules, these fundamentals matter more than ever.

Seller financing remains an important tool for getting deals done, but now comes with more strings attached. Buyers must navigate stricter equity injection requirements, while sellers face new personal guarantee obligations. These dynamics are reshaping how deals are structured and who’s willing to participate.

Aligning Expectations for Buyers and Sellers

To close deals in today’s market, both sides must adapt. Sellers need to understand how SBA changes affect their risk exposure and be prepared to negotiate accordingly. Buyers should be ready to meet new equity requirements and explore creative financing strategies.

Business brokers and SBA lenders play a key role in bridging the gap, helping both parties align expectations, structure compliant deals, and move toward a successful close.

To assemble a team of advisors to help you exit or buy a business, visit BizBuySell’s Broker Directory.