Rising Interest Rates Modestly Affecting Business Sale Prices

We published the latest version of our Quarterly Insight Report a few days ago and has been the case for the past two quarters, all eyes are on business sale prices and multiples. Just like the effect on the stock market and the housing market, rising interest rates can put pressure on business sale prices. Tightening monetary policy means business buyers are having a harder time securing adequate financing to purchase businesses, putting pressure on business owners to lower prices.

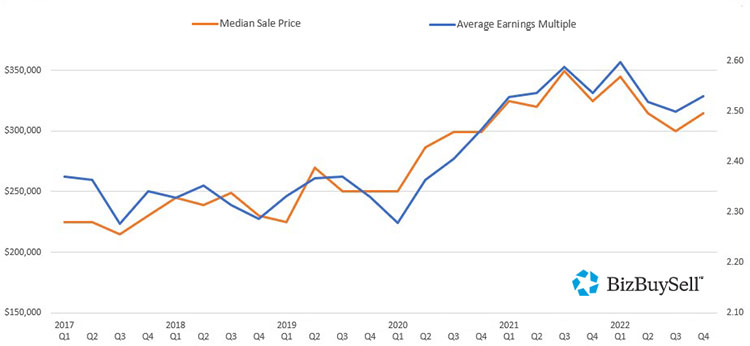

While median sale prices for businesses sold in 2022 dropped 3% from 2021, prices actually rose in the last quarter to $315,000 from $300,000 in Q3. Looking at the five-year trend, there is certainly some cooling-off from the post-Covid peaks, but small business prices and the corresponding multiples remain well above the “normal” pre-Covid levels.

The “New Normal”

No one can predict the future, but so far the impact of rising interest rates has been modest compared to the rise in prices we have seen since the pandemic set markets on fire.

“As interest rates settle, a new normal will set in. During 2022, lenders and buyers were more or less shocked by the rapidly changing rate and business environment and, as a result, many backed off and reassessed their targets and models. I believe many financial buyers will begin to become more aggressive,“ said Max Friar, Managing Partner of Calder Capital, LLC in Michigan.

With so many baby boomers looking to retire, it’s likely that these business owners are looking to sell irrespective of market conditions, and they have some levers at their disposal to get fair value for the businesses they have spent their lives building. Certainly, price will always be a big part of the negotiation, but business sellers may be able to keep the price higher by offering to finance some of the acquisition themselves. Seller financing has always been a great way to bridge the gap between what buyers can afford and what sellers want to receive.

John Inzilla of Murphy Business Sales says, "The high interest rates affect the price but now owners should be open to some level of seller financing. Buyers will be attracted to these businesses over others for the normal reasons (i.e., "skin in the game") but more practically due to rising interest rates in the other lending sources."

Owners Should Have Realistic Expectations

Business owners have been fortunate to see their valuations rise over the past few years, but it’s important to have realistic expectations. Ensure prices are grounded in reality and based on auditable financials. Many businesses never sell, leaving owners to regret deals falling apart over relatively minor price or financing differences.

"Remember, until close of escrow, that sellers are always in a weaker position than buyers. Be as honest and cooperative as possible with the buyer and agent. You must never forget that the key to transaction success lies in the hands of the buyer. Avoid too much tug-of-war with agents or buyers by negotiating a small price,” says Kevin Kim, Bee Investment Inc.

As interest rates make it more difficult for buyers to meet these higher valuations, owners with some wiggle room will be the ones closing their business sales.