Manufacturing Business Sales Slow as Tariffs and Uncertainty Weigh on Market

As the government shutdown enters its 36th day, now the longest in U.S. history, private-sector data is playing a larger role in gauging economic conditions. A recent survey from the Institute for Supply Management shows a slowdown in manufacturing, with tariffs impacting cost, pricing strategies, order volumes and supplier delivery times.

While the manufacturing sector expected to benefit from the Trump administration’s trade and tariff policies, ongoing negotiations and shifting regulations have created uncertainty. And this uncertainty is spilling into the business-for-sale market, where manufacturing business owners looking to exit — and buyers considering a purchase — are reassessing valuations and timing amid shifting conditions.

Manufacturing Business Sales Slow Amid Market Uncertainty

Manufacturing transactions fell 11% year-over-year, and the median sale price dropping 37% to $550,000, according to BizBuySell’s latest Insight Report, which tracks the health of the U.S. small business economy. This mirrors broader industry trends: factory construction spending, which grew from 3.5% of the manufacturing economy in 2021 to 8% in 2024, a 40-year high, has declined from its third-quarter peak, according to analysis by Paul Donovan, global chief economist at UBS Wealth Management, as reported in the New York Times.

Key factors driving this slowdown include ongoing trade uncertainty, tariff fluctuations, supply chain disruptions, and rising costs. These pressures have contributed to lower valuations and fewer completed deals, with median cash flow down 28% and median revenue down 27% year-over-year.

"Tariffs are affecting manufacturing and retail deals. There is a lot of variability in costs, which are fluctuating, so deals may slow down, but they are still progressing,” said AJ Ramsey of Transworld Business Advisors - Eastern NC.

This transactional slowdown in manufacturing may reflect delayed closings rather than reduced interest, as buyers and sellers reassess valuations amid tariff uncertainty and fears that rising costs for imported materials could impact profitability.

Tariffs Drive Up Costs for Manufacturers

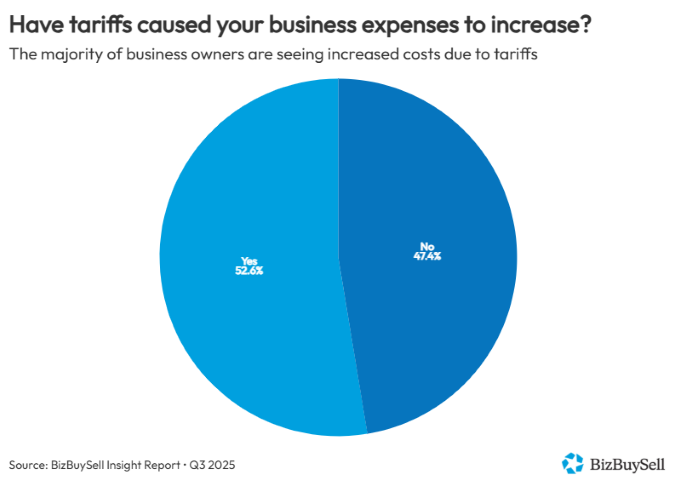

Tariffs are hitting small manufacturing businesses hard, raising input costs while making customers more price-sensitive. According to BizBuySell’s recent survey, more than half of business owners (52.6%) report that tariffs have caused their business expenses to increase, and seven out of 10 owners have adjusted their pricing strategies to compensate.

The ripple effect is also reaching consumers. Nearly 58% of owners say they’ve noticed more cautious consumer spending, while 40.4% report reduced purchase frequency. Another 36% note that customers are selecting cheaper alternatives.

This cost pressure is complicating negotiations and valuations. Sellers are navigating higher operating costs, while buyers are factoring the potential for softer demand. In today’s environment, both sides must be prepared to reassess expectations and adapt to shifting market dynamics.

Timing Your Exit: What Sellers Should Consider

For manufacturing business owners considering a sale, while the current market may be challenging, not all business owners are choosing to wait to list their business for sale.

In BizBuySell’s most recent Insight Report survey of business owners across all industries, when asked whether they’d receive more, less, or the same amount for their business if they sold next year versus today, 40.2% expect to receive a greater amount, compared to 20.3% who expect less. Another 39.5% expect valuations to remain stable. This optimism suggests many sellers believe tariff uncertainty is temporary.

Businesses with strong financials, diversified supply chains, and resilient customer bases may still attract competitive offers from strategic buyers, even in today’s challenging environment.

Financing Roadblocks Add Complexity to Deals

Even motivated buyers and realistic sellers face an additional hurdle: the government shutdown has frozen SBA lending, eliminating one of the most common financing sources for small business acquisitions. Without SBA 7(a) loans — which typically finance 70–90% of small business purchases — buyers must rely on non-SBA business financing options, like cash or conventional bank financing, which requires larger down payments and stronger financials.

This financing freeze adds another layer of uncertainty to an already complex market. Sellers looking for improved valuations in 2026 should consider not only tariff resolution, but also the return of accessible financing for their buyer pool. For buyers with capital ready and sellers with well-positioned businesses, opportunities remain.

Why the Right Business Matters More Than Perfect Timing

While market conditions remain uncertain, waiting for ideal conditions could mean missing a solid opportunity. If your valuation is grounded and you're ready to move on, now may be the right time to sell.

“If you are ready to exit the business and you have a realistic valuation that makes sense, move now. Don’t wait for some ‘perfect time,’” said Michael Weisbeck of Sunbelt of North Dakota.

Whether buying or selling, success depends more on preparation, clean financials, and operational strength than timing. A well-positioned business with strong fundamentals can attract serious interest, even in a shifting market.