Small Business Owners Hope for Tax Cuts Under Incoming President Trump

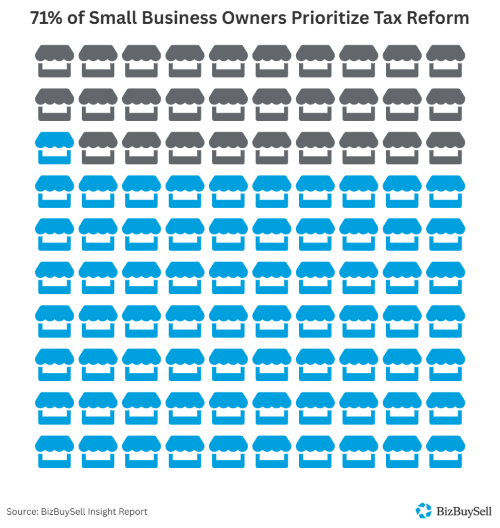

Small business owners across America are grappling with a complex tax system that challenges their bottom line. BizBuySell's latest Insight Report shows that tax reform is the top concern for 71 percent of small business owners, ahead of both access to capital (63 percent) and healthcare costs (50 percent).

These concerns come at an important moment as tax provisions from the 2017 Tax Cuts and Jobs Act (TCJA) reach key implementation phases. Two key changes are affecting business operations: bonus depreciation, which dropped from 80 percent in 2023 to 60 percent in 2024 and will reach zero by 2027—and since 2022, businesses must spread research and development (R&D) costs over five years instead of deducting them immediately.

Rising Tax Pressures on Main Street

"Any reduction of income tax helps business since income tax is a destructive system that penalizes production and harms the economy," notes one business owner, reflecting a common sentiment among Insight Report survey respondents. However, tax policy is complex and nuanced. The nonpartisan Committee for a Responsible Federal Budget reports the 2017 TCJA contributed to adding $8.4 trillion to the national debt over ten years through a combination of tax cuts ($2.5 trillion) and spending increases ($4.9 trillion).

For manufacturers, Trump’s proposal to reinstitute the domestic production activities deduction (DPAD) from 28.5% to a lower 15% effective corporate tax rate could provide substantial relief. However, some business owners remain skeptical about targeted tax policies. As one survey respondent noted, "Although it sounds like a great idea, the loss of tax revenue to the IRS will, of course, need to be supplemented somewhere else which will probably end up raising my taxes."

How Businesses Are Adapting

Tax policy is affecting business operations in several key areas, according to the BizBuySell Insight Report survey. Payroll and employment costs remain a primary concern, with proposed changes to tip tax policy drawing mixed reactions from owners. "It would complicate payroll but would improve bottom line significantly if both employee and employer overtime tax was eliminated," shares one business owner. Another respondent points out existing disparities: "Currently, salons do not enjoy the same rules as restaurants where their tip income is exempt from SS [Social Security] and Medicare payments."

Investment and growth planning has shifted as bonus depreciation benefits decline annually and R&D costs now require five-year amortization, leading businesses to adjust their investment strategies.

Some owners express broader concerns about the combined effect of various policy changes. As one business owner observes, "I think the Republican party is historically more friendly to small businesses, but Trump's tariff plan would have a highly negative impact on the costs for both consumers and small businesses that would require a high degree of unknown positives."

Looking Ahead

The incoming administration's proposals would reverse several TCJA provisions that are currently impacting businesses, including making permanent the 100% bonus depreciation and restoring immediate R&D expensing. These changes come as part of a broader tax reform agenda, though business owners and policy analysts note the importance of considering both immediate benefits and long-term fiscal impacts.

The Tax Foundation's analysis suggests these changes could boost the economy, projecting a 0.8 percent increase in GDP and wage growth, along with 597,000 new full-time equivalent jobs. However, the impact would vary across business sizes and sectors.

Despite these challenges, small businesses remain adaptable. The shift from existing policies to the proposed reforms could reshape the tax environment for small businesses, particularly when considered alongside other economic factors like inflation and trade policy changes. Tax policy changes often have complex and long-lasting effects that extend beyond their initial projections, as Main Street businesses look ahead to potential tax relief in 2025.