The Fed Cuts Interest Rates: How It Impacts Small Business Transactions

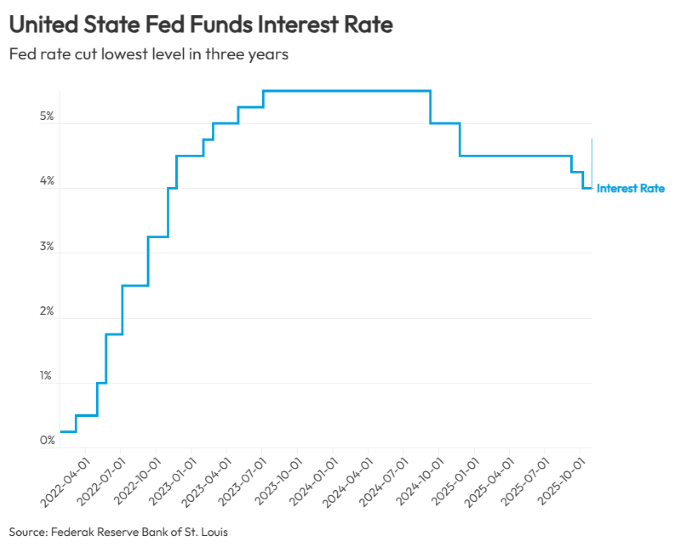

On October 29, the Federal Reserve cut interest rates by a quarter point to a new range of 3.75- 4.00 percent, the lowest level in three years. This marks the second rate cut in 2025. The Fed cited rising inflation and an unstable labor market as key factors in its decision to cut rates. In public comments, Chair Jerome Powell noted a divided board and the ongoing government shutdown, which has made collecting and reporting data more difficult. With uncertainty clouding the data, the outcome of the Fed’s December meeting remains open for discussion.

Lower interest rates reduce borrowing costs, leading to lower monthly payments on loans. For Main Street businesses with existing debt or plans to borrow for growth intitiaives, the rate cut offers welcome relief. Entrepreneurs considering acquisitions may also benefit, as lower rates ease borrowing costs and ease the transition of ownership for many Main Street businesses.

How Lower Interest Rates Affect Small Business Owners

Economic uncertainty continues to shape business owner sentiment in 2025. Main Street businesses are navigating a challenging labor market, elevated inflation, and tariff concerns, factors that have many owners in a cautious stance.

BizBuySell’s Q3 2025 Insight Report, which tracks the health of the U.S. small business economy, surveyed owners on a range of issues. While 41% of respondents plan to hire in the coming year, 53% do not expect the labor market to improve. Compared to Q3 2024, there was a 2% increase in “unsure” responses, highlighting the persistent uncertainty gripping small business owners.

When asked how interest rate cuts are influencing decision-making, 68.9 % of business owners reported no changes at this time. Among those taking action, some plan to invest in business improvements, purchase new equipment, expand operations, or hire staff. Fewer than 4% intend to lower prices in response to reduced borrowing costs. With 62% of small business owners reporting that they do not see inflation easing, the impact of lower rates remains limited.

Will Cheaper Borrowing Drive More Business Acquisitions?

BizBuySell’s Insight Report also surveyed. Nearly one in four say they are accelerating their timeline to buy a business due due to the Fed’s rate cuts. That said, the majority of entrepreneurs surveyed (60%) report no change on on their acquisition plans, and 16% are delaying their timeline due to borrowing costs.

What Brokers Say About Rate Cuts and Deal Flow

Business brokers surveyed for the Q3 2025 Insight Report are divided on how rate cuts will affect deal flow in the coming quarters. While 42.3% believe the cuts will have no significant impact, one in four expect buyers to accelerate purchases to lock in favorable financing. Only 7.5 % think sellers will delay listings in hopes of achieving higher valuations.

Some brokers say the cuts aren’t large enough to influence deal flow, while others note that buyers and sellers understand there’s never a perfect time to buy or sell a business. Tighter loan underwriting continues to challenge financing efforts. David A Smith of The Agency NW RE shared, “I hear a lot of noise on the economy as far as inflation and tariffs or other politically motivated topics, but when the rubber hits the road, I don't see these factoring into deals in most industries. High interest rates remain the most impactful economic barrier for deals.”

With Wall Street and government officials pressuring Fed Chair Jay Powell for another rate cut in December, Main Street transactions continue to adapt. Small business confidence suggests sellers will adjust pricing and expectations, while buyers remain focused on value and lower risk opportunities in the short term. For help navigating buying or selling your business, visit BizBuySell's Broker Directory to connect with an experienced advisor.