How Much Money Do You Need to Buy a Business?

As entrepreneurship through acquisition gains momentum from university lecture halls to social media influencers, one question consistently stands out: exactly how much money do you need to buy an existing business?

There’s plenty of buzz around buying a business with no money down, but the reality is that a reasonable investment is required, and it’s well within reach. Buyers who understand today’s financing landscape will find legitimate opportunities to buy businesses and close deals with confidence.

Upfront Costs Every Buyer Should Plan For

When it comes to buying a business, there are a few upfront costs entrepreneurs should be prepared for. Most acquisitions require a down payment, and buyers should also plan to have cash reserves available for working capital. Demonstrating financial readiness not only strengthens your position with lenders, but it also signals to sellers that you’re a serious buyer committed to making the business succeed.

The Small Business Administration (SBA) mandates a minimum 10 percent down for 7(a) loans, and sellers want buyers to have “skin in the game.” Typically, buyers need 10–20 percent down with SBA financing, and some acquisition loans require 20–25 percent. Down payment requirements vary depending on the type of financing used — SBA loans tend to offer more flexible terms, while traditional bank and acquisition loans may require higher equity and collateral.

In addition to the down payment, buyers should be prepared for working capital: the funds needed to keep the business running smoothly after the sale. It’s calculated as current assets (like cash, accounts receivable and inventory) minus current liabilities (such as accounts payable and short-term debt). Working capital is often negotiated as part of the purchase agreement to ensure the buyer has enough liquidity for day-to-day operations. As one broker shared in BizBuySell’s Insight Report Q2 2025 survey, “Make sure you have 20% liquid prior to making an offer. Almost all lenders now are requiring 10% post liquidity.” Having these reserves in place helps buyers avoid early financial strain and supports a smoother transition into ownership.

Other upfront costs may include professional fees for due diligence, such as accountants, attorneys or valuation experts. Depending on the business type, buyers may need to budget for licenses, permits or insurance, and in some cases, initial inventory or equipment upgrades.

While these costs vary, being financially prepared sets you apart as a serious buyer and helps ensure a smooth path to ownership.

Determining Your Down Payment

BizBuySell’s Insight Report, which tracks the health of the U.S. small business economy, analyzed sales and listing prices across the country. In Q2 2025, the median sale price was $352,000, compared to a median asking price of $399,000 — resulting in a sale-to-ask ratio of 0.93. This data shows buyers are negotiating effectively and securing deals below asking price.

For entrepreneurs, this translates into realistic down payment requirements: buying a median-priced business could require anywhere from $35,200 to $52,800 in cash. Buying an established business often provides better value than starting from scratch, offering immediate cash flow, established customer bases, and proven business models that make your investment work hard from day one.

Why Market Timing Matters in 2025

The financing environment in 2025 presents a unique window of opportunity. After a period of elevated interest rates, the Federal Reserve lowered rates on September 17 by a quarter percentage point. With one in six buyers sharing with BizBuySell that they are delaying their business purchase in anticipation of lower interest rates, conditions are shifting in favor of dealmakers.

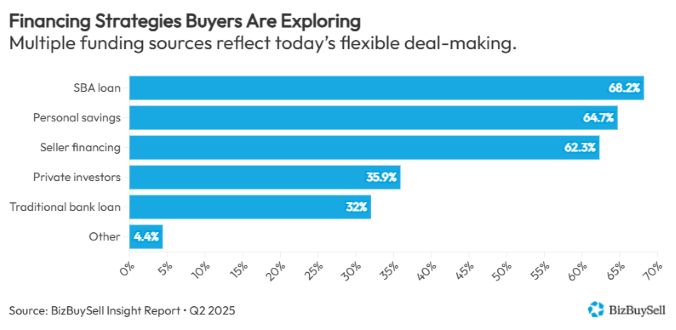

Buyers surveyed in BizBuySell’s Insight Report are turning to SBA loans (68.2%), personal savings (64.7%) and seller financing (62.3%) to finance their acquisitions. Sellers, meanwhile, are looking for buyers who are ready to invest in the future of the business they built and take it to the next level.

Financing Options and Capital Requirements

There’s no one-size-fits-all approach to financing a business acquisition, but understanding your options, and the capital requirements that come with them, can help you move forward with confidence.

- SBA loans require a minimum 10 percent down, though most fall between 10–15 percent. These government-backed loans offer favorable terms and longer repayment periods, making them a popular choice for first-time buyers.

- Traditional bank loans typically require 10–20 percent down and may come with stricter credit and collateral requirements.

- Business acquisition loans often require 20–25 percent down and are best suited for experienced buyers with substantial assets.

Creative Financing Strategies

In today’s market, buyers are exploring flexible financing options to make deals work.

- Seller financing has gained traction as interest rates fluctuated. Sellers may offer to finance 5–60 percent of the purchase price, but they still expect buyers to contribute a meaningful down payment to show commitment and reduce risk.

- ROBS financing (Rollovers as Business Startups) allows buyers to use retirement funds—such as 401(k) accounts, without penalties. This strategy has become increasingly popular among corporate professionals transitioning into entrepreneurship.

- HELOCs (Home Equity Lines of Credit) are another tool buyers are using to fund acquisitions. By tapping into the equity in their homes, buyers can access flexible capital to cover down payments or working capital needs. While not suitable for every situation, HELOCs can offer competitive interest rates and quick access to funds, especially for buyers with strong personal credit and sufficient home equity.

What This Means for Today’s Buyer

For most buyers, the search for the right opportunity can stretch from six months to a year or two. In Q2 2025, the median days on market was 176 — just under six months. With motivated buyers and sellers, and businesses offering existing cash flow and revenue streams, lenders have more predictable data to evaluate. That makes financing decisions more straightforward.

How to Position Yourself for Financing Success

Securing financing isn’t just about having enough money, it’s about presenting yourself as a qualified, credible buyer.

- Create a buyer and financial profile: This document outlines your background, financial capability, industry experience and acquisition goals.

- Prepare clean financial statements: Organized personal and business finances accelerate the approval process and demonstrate professionalism.

Whether you’re an individual buyer, investor or strategic acquirer, positioning yourself well from the start can make all the difference.

Looking Ahead: Are You Ready to Buy a Business?

The question isn’t just how much money you need to buy a business — it’s whether you’re ready to take the next step toward ownership. With the right preparation, financing strategy and mindset, business ownership is not only possible, but also within reach.

Visit BizBuySell’s Financing Center to explore your options and connect with qualified lenders.