Exit on Top: Why Now Is a Great Time to List Your Business for Sale

As we reach the mid-point of 2023, the economy continues to show signs of strength despite concerns of a looming recession. At the Federal Reserve’s most recent meeting, the Fed acknowledged the robust labor market and resilient banking system while remarking that inflation, while waning, remains elevated. As the Fed pauses rate hikes for June to evaluate the impact of previous increases, the economy continues to outperform projections. The pause in rate hikes coupled with the S&P 500 flirting with bull market territory has small business owners looking to capitalize on the recent economic good news.

Buyer Demand Remains Strong with Sellers Reporting Solid Financials

According to BizBuySell’s Insight Report, a nationally recognized economic indicator that monitors the health of the U.S. small business economy, nearly one-third (28%) of business owners intend to accelerate their exit timeline. For entrepreneurs planning to sell their business this year, there is good news as demand from buyers is on the rise. BizBuySell’s business-for-sale marketplace has experienced a 27% increase in monthly online visits compared to the previous year, suggesting a growing demand for business ownership.

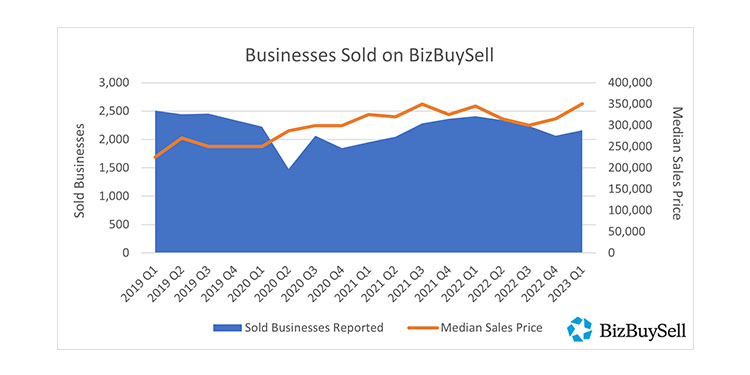

Strong financials were reported by businesses sold in the first quarter of 2023, indicating a positive trend in the market. With 2,162 closed transactions, business sellers reported an all-time high for median revenue, $700,000, and median sale prices, $350,000. Cash flow remains steady, despite inflation and labor costs, at $155,000 for Q1 2023. With median revenue up 6.7% over the previous year and median cash flow up 2.8% respectively, indicating that businesses which perform well are highly sought after by buyers.

Determining When to List Your Business for Sale

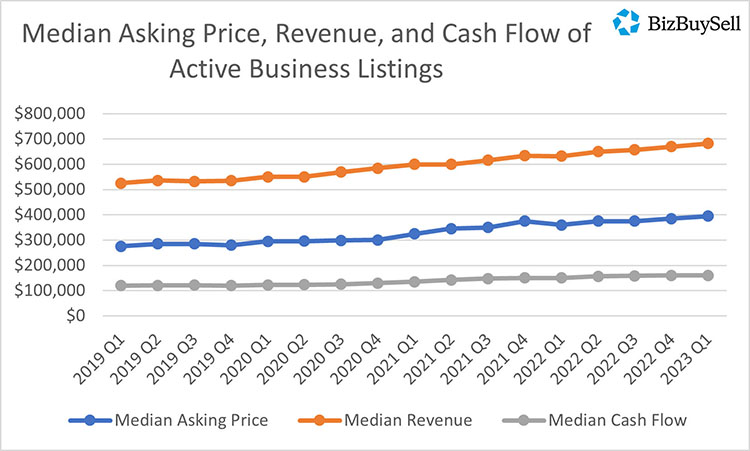

For those on course to list and prepare their business for sale, assessing the value of your business is the first step when developing an exit plan. When it comes to evaluating the impact of current economic conditions on valuation, profits remain the single most important factor in business valuations. In addition to the profit a business has generated in the past, interested buyers will want to know how much the business is likely to make in the future. Insight Report trends show key financials of median asking price, revenue and cash flow continue to rise, despite the varied economic landscape of the last few years.

In the first quarter of 2023, BizBuySell analyzed 35,222 active small business transactions in the United States. The median asking price for businesses for sale was $395,000, and these businesses had a median revenue of $681,873 and a median cash flow of $160,415. Entrepreneurs are capitalizing on the current market by purchasing businesses with strong financials.

To learn more about trends in the business for sale marketplace, check out BizBuySell’s quarterly Insight Report. The report offers essential economic insights into small business transactions by analyzing sales and listing prices for businesses nationwide. The latest economic data will enable you to determine the right time to list your business for sale.