Credit Card Fees: Impact on Small Business Bottom Line and Valuation

The stock market’s historical volatility in August serves as a reminder of the ongoing challenges that Main Street businesses have faced in an uncertain economy over the past few years. As the Federal Reserve looks to steer the economy towards a smooth landing, business owners remain cautiously optimistic amidst a rebound in stock sell-offs and a welcome drop in inflation below 3% for the first time in three years. While many aspects of the economy remain uncertain, one pressing issue is the impact of credit card fees, which are affecting both the day-to-day operations and the long-term business valuations.

Credit Card Companies Courting Main Street

American Express’s recent acquisitions of restaurant platforms Resy in 2019 and Tock and Rooam in 2024 highlight a growing trend: credit card companies recognize the value of the small business market and are actively pursuing opportunities, particularly in the restaurant and hospitality sectors. By integrating themselves into the day-to-day operations of Main Street businesses, credit card companies can go beyond payment processing and offer a wider range of services.

These integrations not only promise to make things run smoother and engage customers better, but they also show that credit card companies are trying hard to secure their place in the small business world. This could potentially make it more challenging for small businesses to negotiate favorable fee structures. Over the past decade, credit card processing fees have more than doubled. Small businesses are faced with the choice of increasing prices or settling for lower profits, which impacts not only cash flow and day-to-day operations but business valuation.

Impact on Small Business Operations and Valuations

Credit card fees, typically ranging from 1.5% to 3.5% per transaction, weigh heavily on a small business’s bottom line. In the current economic climate, these fees add to the challenges of maintaining profit margins.

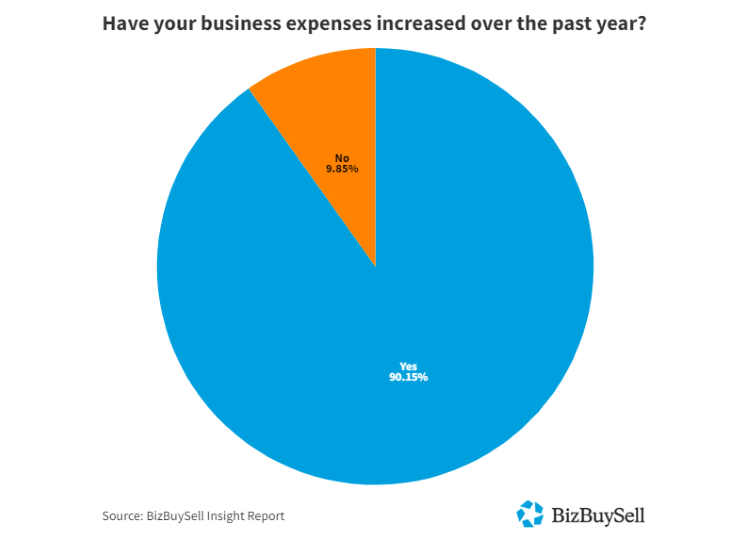

According to the latest BizBuySell Insight Report, which tracks the health of the small business economy:

- 68.79% of business owners report that inflation is not easing, despite being at its lowest level since 2021.

- 90.15% share that business expenses have increased over the past year, including credit card processing fees.

- To combat rising costs, 67.10% of business owners have adjusted their price strategies.

- In response to price changes, 64.57% of customers have remained neutral, but nearly a quarter have reacted negatively.

In addition to transaction fees, small businesses also have to contend with the financial burden of chargebacks and fraud. These issues affect more than just daily operations and cash flow - they can also significantly influence the valuation of a business. When conducting due diligence in business acquisitions, potential buyers closely examine a company’s risk management capabilities. High chargeback rates or frequent fraud incidents are seen as red flags that can decrease the business’s overall worth.

Looking Ahead

Despite these challenges, small business owners are adapting. To counter increased costs, some are coming up with innovative pricing strategies while still prioritizing customer satisfaction. Others are negotiating with payment processors for better rates.

The world of credit card fees and small business finance is constantly evolving. New payment technologies and potential regulatory changes could reshape the entire sector. The BizBuySell Insight Report indicates that small business owners maintain a cautiously optimistic outlook with about 34% of reporting improvements through increased sales and another 33% maintaining steady performance compared to the previous year.

As small businesses navigate this complex environment, staying informed and nimble remains important. By understanding the impact of credit card fees and exploring strategies to manage them, business owners can better position themselves for success in both daily operations and potential future sales, ultimately enhancing their business valuation.