How the Big Beautiful Bill Impacts Small Businesses

On July 4, the Trump administration’s Big Beautiful Bill was signed into law, setting the stage for change across the small business landscape. Many of the bill’s provisions are aimed at helping businesses grow, increase their market value, and create a more competitive environment for both buyers and sellers. While the legislation promises immediate benefits for Main Street business owners, it also raises some questions, particularly around healthcare and compliance, that could present challenges for some.

What Small Business Owners Want Most from Policy

Small businesses, defined by the Small Business Administration as those with 500 or fewer employees, make up 99.9% of all businesses in the United States. BizBuySell’s Insight Report, which tracks the health of the small business-for-sale market, surveys business owners and entrepreneurs about a wide range of issues, including the policies they consider most important. 45.3% of owners surveyed for the Insight Report identified tax policy as one of the top issues they want the Trump administration to address.

How the Big Beautiful Bill Support Small Business Growth

The Big Beautiful Bill extends several tax provisions that were set to expire, offering relief and incentives for small business owners. Many Main Street businesses — sole proprietorships, partnerships, LLCs, and S corporations — benefit from pass-through taxation, which allows income to be taxed at the individual level. The bill makes the qualified business income deduction permanent, a move that the National Federation of Independent Businesses called, “the most important thing Congress can do to help small businesses and their workers.”

Additional tax benefits include:

- Immediate expensing: Small businesses can now write off 100% of the cost of property such as equipment, vehicles, software, furniture, and machinery. Previously, only a portion of these costs could be deducted.

- R&D deductions: Businesses can now deduct research and development expenses in the year they occur rather than spreading them over five years.

- Third-party payment threshold increase: The IRS reporting threshold for platforms like Venmo and PayPal has increased from $600 to $20,000 and over 200 transactions per year, reducing paperwork for small businesses.

- Tip income deduction: Employees and self-employed individuals in eligible occupations can deduct up to $25,000 in qualified tips received from customers or through tip sharing. This provision is available through 2028.

- Overtime pay deduction: Employees can deduct the “half” portion of time-and-a-half overtime pay, up to $12,500 annually ($25,000 for joint filers), effective through 2028.

- Expanded employer-provided childcare credit: The BBB increases the portion of the tax credit for qualified childcare expenses from 40% (from 25%), or up to 50% for eligible small businesses. It also raises the maximum credit to $600,000 for small business. This helps businesses attract and retain talent.

While the bill introduces a range of tax incentives, the relief may feel especially timely. According to BizBuySell’s most recent Insight Report, 54.6% of small business owners say they have not felt relief from inflation and rising costs – making these tax provisions a welcome development.

Challenges Small Business Owners May Face Under the BBB

While these provisions may lead to increased investment and growth, the bill also poses certain challenges:

- Deficit concerns: The legislation is projected to add more than $3 trillion to the federal deficit over the next decade, which could lead to rising borrowing costs, impacting small businesses looking for capital.

- Healthcare benefit flexibility – with limitations: The bill includes expanded access to Health Reimbursement Arrangements (HRAs), allowing employers to reimburse employees for individual health insurance premiums and other qualified expenses. The effectiveness of these HRAs depends on how businesses implement them and whether employees can find affordable coverage options.

- Cuts to Medicaid and Medicare: The bill also includes cuts to Medicaid and Medicare funding, which could limit access to affordable healthcare for millions of Americans. For small businesses, this could make it harder to attract and retain workers who rely on these programs for health care.

What This Means for Buyers, Sellers, and the Market

Overall, the bill introduces pro-growth tax policies that create a stable business-friendly environment. Both buyers and sellers benefit from the predictability and advantages these policies offer, encouraging more deals and investments in the small business market. A supportive tax framework gives entrepreneurs the confidence to move forward, helping drive activity across the sector.

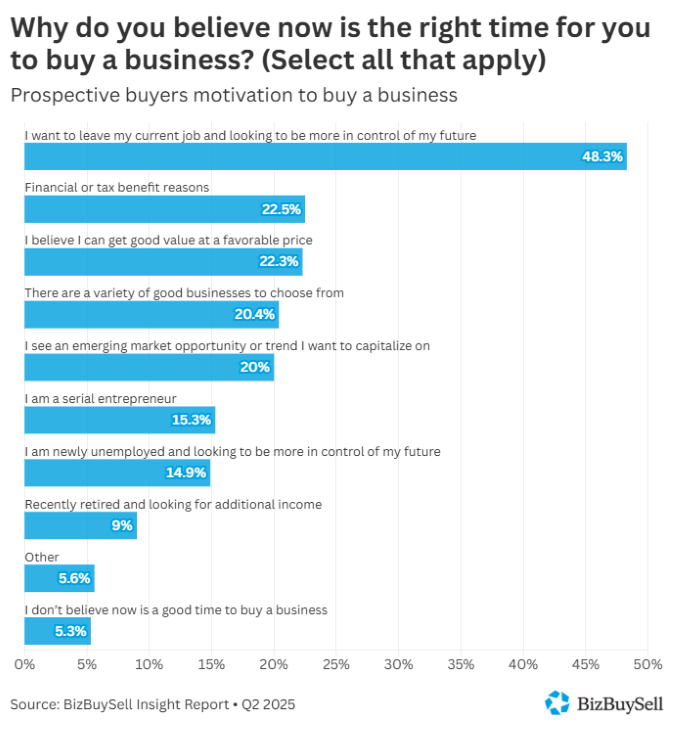

The Big Beautiful Bill offers a range of benefits that can strengthen the growth potential of small businesses. From tax deductions and expensing rules to expanded employee incentives, the bill brings renewed confidence to the business-for-sale market. In fact, 22.5% of entrepreneurs surveyed by BizBuySell said they believe now is the right time to buy a small business, pointing to financial or tax advantages as a key reason. As the market adjusts and reacts to the current economic climate, these tax policy changes may help fuel momentum for buyers, sellers and the broader small business community.