Sellers Cashing Out: Sold Small Business Revenues, Cash Flow Reach Record Highs In Early 2016 While Number Of Business For-Sale Listings Hit Seven-Year Peak

BizBuySell's First Quarter 2016 Insight Report shows highest number of small businesses listed for sale since 2009, service and retail industries driving improving financial performance of sold businesses.

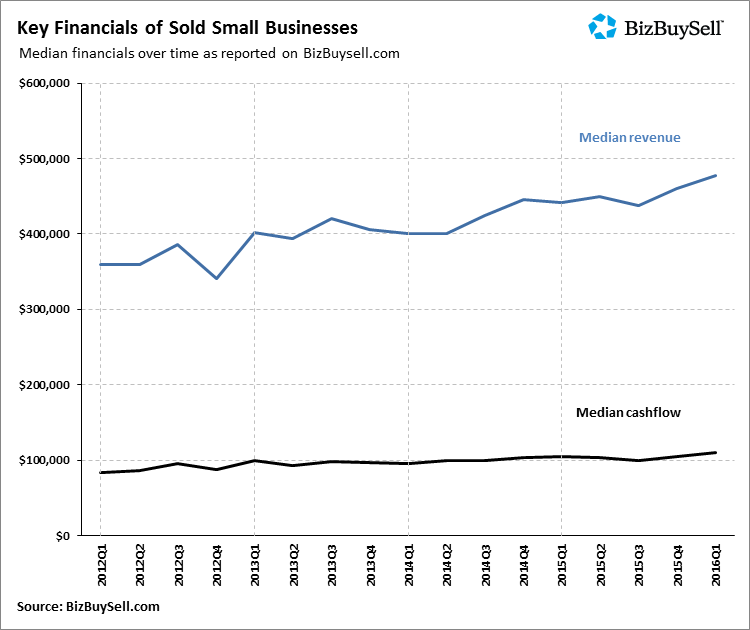

San Francisco, CA - BizBuySell.com, the Internet's largest business-for-sale marketplace, reported today that the median revenue and median cash flow of sold small businesses in the first quarter of 2016 reached their highest levels since BizBuySell first started tracking data in 2007. This is notable as the increased financials are resulting in higher sale prices for small businesses. The full results are included in BizBuySell's Q1 2016 Insight Report, which aggregates statistics from business-for-sale transactions reported by participating business brokers nationwide.

A total of 1,840 closed transactions were reported in the first quarter of 2016, a slight increase from the 1,830 transactions in the first quarter of 2015, however the businesses that sold this quarter appear to be much healthier. Businesses sold in the first quarter of 2016 grossed a median revenue of $478,000 compared to $442,000 last year, and a median cash flow of $110,000 compared to $104,000. These figures represent the highest median revenue and median cash flow of sold businesses on record at BizBuySell.

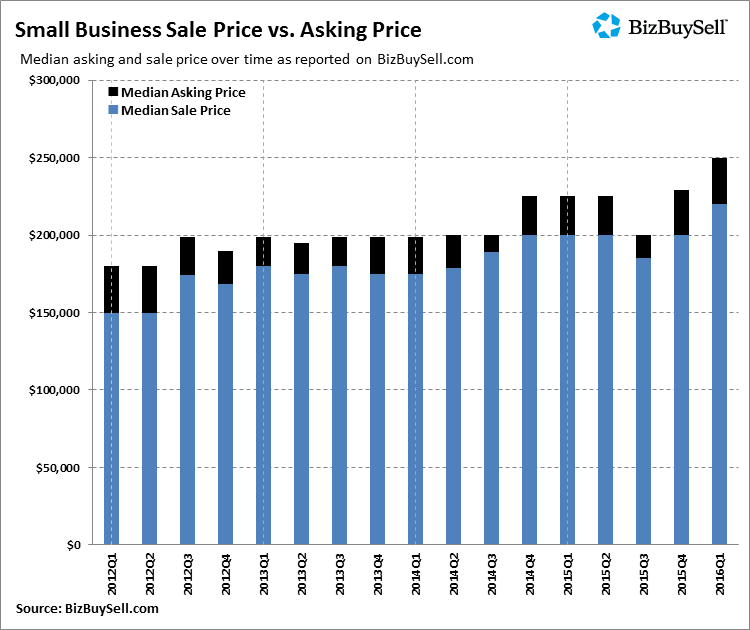

The improving financials are allowing sellers to ask for and receive more during the sales process. The median small business asking price grew 11 percent in the past year to $249,500, while the median sale price increased 10 percent year-over-year from $200,000 to $220,000. That marks a healthy average sale to asking price ratio of 90 percent. The increase in sale price is a great sign for sellers as it suggests the market may be shifting in their favor.

Supply of Small Business Listings Reaches Seven Year High

As business financials strengthen and sale prices grow accordingly, it appears more owners are deciding now is a good time to sell. The number of businesses listed for-sale grew more than 6.4 percent from the same time last year. The Q1 2016 listings total marks the highest number of businesses listed for sale on BizBuySell since the first quarter of 2009, after which both listings and sales dropped significantly in response to the economic downturn. The uptick in small business listings this quarter is likely due to a number of factors, including growing small business financial performance and resulting sales prices, as well as the increasing number of Baby Boomers reaching retirement age.

Similar to those sold in Q1, listed businesses appear to be financially healthy. The median revenue of listed businesses in Q1 increased 4 percent from this time last year to $468,000, while the median cash flow rose 3.8 percent to $106,736. Despite improving financials, however, the median asking price remained the same, suggesting there is still a good value opportunity for potential buyers.

"While we've seen the number of small business transactions stabilize in the past few quarters, it's good to see the financial performance of small businesses continue to improve early in 2016," Bob House, Group GM of BizBuySell.com and BizQuest.com, said. "The growth in listing supply shows that small business owners are feeling more confident in the market. As business financials strengthen, and sellers continue to receive strong returns, we expect to see an active, balanced market in the upcoming quarters."

Service and Retail Financials Climb, While Restaurants See A Decline

Both the service and retail industries appear to be keeping pace with the improving health of small businesses around the country. The median revenue of businesses sold in the service industry jumped from $322,686 in Q1 2015 to $375,720 in Q1 2016. The median cash flow also increased from $104,000 to $114,370 during that same period. Those increased financials allowed sellers to both ask for and receive more for their service businesses. The median asking price grew 19 percent to $260,000, while the median sale price jumped from $190,800 in the first quarter of 2015 to $226,000 in the same period of 2016.

Similarly, the financials of sold retail businesses continued on a positive trend. The median revenue of retail businesses rose from $537,500 in Q1 of 2015 to $551,052 in Q1 of 2016 and the median cash flow of sold retail businesses increased from $99,355 to $103,227. However, the median sale price only experienced a slight bump from $197,250 to $199,000.

The restaurant industry, on the other hand, experienced a slight decline in performance this quarter. The median revenue of sold restaurants decreased from $475,225 in the first quarter of 2015 to $432,000 in the first quarter of 2016, and the median cash flow also slipped in that time from $95,500 to $80,500. At the same time, the median asking price slid 10 percent to $159,000 and the median sale price decreased from $149,500 to $148,000. While this dip in financial performance shouldn't be seen as a seismic threat, it may hint at how increased labor, healthcare and operating costs are affecting the industry. This industry in particular is keeping a very close eye on changing local and national regulations impacting minimum wage rates and health insurance requirements.

"Overall this quarter's data confirms that small business listings, transactions and financials are all continuing on a positive trend to start the year," said House. "Historically the second quarter of the year has been one of our most active so we expect transactions to continue at a high pace as more buyers step up to take on the growing supply of financially strong listings. In short, all the fundamentals point to a continued strong spring and summer in the business-for-sale market"

About the BizBuySell.com Insight Report

BizBuySell.com is the Internet's largest marketplace for buying or selling a small business, with over 1.4 millionmonthly visitors. The company releases its BizBuySell.com Insight Report on a quarterly basis, reporting changes in closed transaction rates, valuation multiples and other economic indicators for the small business transaction market. Closed transactions are reported to BizBuySell.com on a voluntary basis by business brokers nationwide. To find a qualified business broker in your area, visit www.bizbuysell.com/business-brokers.

NOTE: For additional statistics, please see the latest BizBuySell Insights Report

Media Contact:

Adam Debussy

BizBuySell

email: adebussy@bizbuysell.com

About BizBuySell

BizBuySell is the Internet's largest business for sale marketplace. Since 1996, BizBuySell has offered tools that make it easy for business owners and brokers to sell a business, and potential buyers to find the business of their dreams. BizBuySell currently has an inventory of approximately 48,000 businesses - spanning 80 countries - for sale at any one time and receives more than 1 million monthly visits. The site also features an extensive franchise directory as well as an easy-to-use business valuation tool. Please visit www.bizbuysell.com for more information.

BizBuySell was founded in 1996 and in 2012 became a division of CoStar Group, Inc. (NASDAQ - CSGP) - commercial real estate's leading provider of information and analytic services. CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information and offers a suite of online services enabling clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. For more information, visit www.costar.com.