Small Business Transactions Reach Record Levels in 2014, Increase Over Six Percent From Previous High in 2013 According to BizBuySell.com Report

BizBuySell.com's Fourth Quarter 2014 Insight Report shows transactions continue to increase thanks to improving small business financials, retiring Baby Boomers; Seller confidence leading to higher asking and sale prices in fourth quarter.

San Francisco, CA - BizBuySell.com, the Internet's largest business-for-sale marketplace, reported today that small business transactions reached record levels in 2014 as brokers reported the highest number of businesses changing hands since BizBuySell started tracking data in 2007. The full results are included in BizBuySell.com's 2014 Insight Report, which aggregates statistics from business-for-sale transactions reported by participating business brokers nationwide.

A total of 7,494 closed transactions were reported in 2014, an increase of over six percent from the 7,056 transactions in 2013, which was the previous record. This marks the second straight year of such strong activity after several slow years during and immediately following the recession. On average, 2013 and 2014 transaction totals are up 55 percent over the recession and recovery period from 2010 through 2012.

The increasing volume of small businesses changing hands can be attributed to a number of factors. In BizBuySell's December survey of business brokers, respondents cited an increase in the number of qualified buyers in the market as the top driver of growth. The second most common response was the general improvement of the small business environment. At the same time, retiring Baby Boomers account for many of the new sellers in the market. In the same survey, more than 78 percent of business brokers attributed at least a quarter of their closed transactions to Baby Boomer sellers.

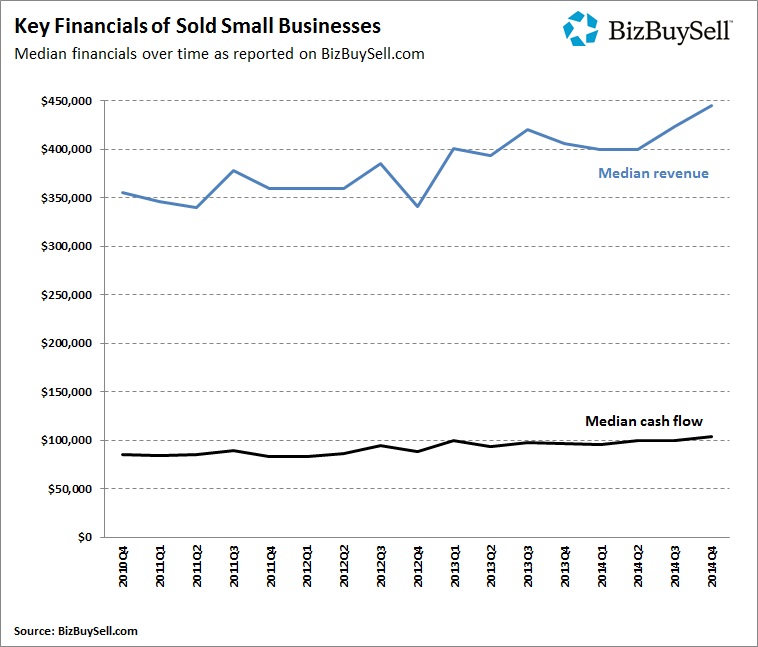

Insight Report data supports the belief that small businesses are performing at a higher level. The median revenue of small businesses sold grew from $405,905 to $417,562 in 2014, and the median cash flow rose from $97,000 to $100,000.

Improving financials gave sellers more leverage during the sales process, leading to a slight uptick in median sales price as well, from $180,000 in 2013 to $185,000 in 2014. Financial multiples grew modestly as the average revenue multiple rose from 0.59 to 0.61 and the average cash flow multiple moved from 2.21 to 2.24. This indicates that while sellers are getting slightly higher returns out of their businesses, buyers continue to receive good value on their purchases.

"It was great to see the transaction surge from 2013 carry over and even swell in 2014," Bob House, Group GM of BizBuySell.com and BizQuest.com, said. "Small businesses continue to grow healthier, giving sellers confidence that they can receive a good exit price and buyers optimism that they are receiving a sustainable business. The result is a market with many successful transactions for both sides."

Fourth Quarter Continues Growth Trend; Financials Reach All-Time Highs

In addition to the annual data, BizBuySell's Insight Report also revealed a strong fourth quarter to end the year. The 1,848 closed transactions in Q4 2014 represent a 12 percent increase from the same period in 2013. Q4 2014 also marked the third consecutive quarter of increased median revenue, topping out at $445,146; the median cash flow hit $103,829. Both financial indicators are at their highest point since BizBuySell started tracking the data in 2007.

These improved financial numbers are allowing sellers to both ask for and receive more money for their businesses. The median asking price for a small business grew to $224,990 in Q4 2014 after sitting around the $200,000 mark for much of 2013 and early 2014. Asking for more money appears to pay off as the Q4 median sale price stands at $200,000, a strong increase from both Q4 of 2013 ($175,00) and Q3 of 2014 ($189,000).

"While 2014 in its entirety was a big year, it's a good economic indicator that Q4 ended so well," House added. "The record-high financials are a particularly strong positive for the business-for-sale market and small businesses overall."

Data Points to Continued Growth in 2015

Even with all the transaction activity occurring in 2013 and 2014, there still appears to be strong supply and demand in the pipeline for 2015. As the economy continues to strengthen, small business financials are likely to keep improving, and sellers will be more confident that they can successfully exit their businesses.

Brokers in BizBuySell's survey agree as 82 percent expect transaction activity to increase in 2015 and more than 45 percent believe final sales prices will rise in 2015 compared to just 12 percent who believe they will decrease. And while Baby Boomers were active in 2014, brokers are confident they will remain a driver of supply. Seventy-eight percent of brokers said they expect a larger number of Baby Boomers to exit their businesses in 2015 than did in 2014.

"The number of small business listings on BizBuySell.com and BizQuest.com continue to grow as more owners begin the process of selling," House said. "While the peak of this activity is unknown, all the fundamentals signal another strong market in 2015."

About the BizBuySell.com Insight Report

BizBuySell.com is the Internet's largest marketplace for buying or selling a small business, with over 1.4 millionmonthly visitors. The company releases its BizBuySell.com Insight Report on a quarterly basis, reporting changes in closed transaction rates, valuation multiples and other economic indicators for the small business transaction market. Closed transactions are reported to BizBuySell.com on a voluntary basis by business brokers nationwide. To find a qualified business broker in your area, visit www.bizbuysell.com/business-brokers.

NOTE: For additional statistics, please see the latest BizBuySell Insights Report

Media Contact:

Adam Debussy

BizBuySell

email: adebussy@bizbuysell.com

About BizBuySell

BizBuySell is the Internet's largest business for sale marketplace. Since 1996, BizBuySell has offered tools that make it easy for business owners and brokers to sell a business, and potential buyers to find the business of their dreams. BizBuySell currently has an inventory of approximately 48,000 businesses - spanning 80 countries - for sale at any one time and receives more than 1 million monthly visits. The site also features an extensive franchise directory as well as an easy-to-use business valuation tool. Please visit www.bizbuysell.com for more information.

BizBuySell was founded in 1996 and in 2012 became a division of CoStar Group, Inc. (NASDAQ - CSGP) - commercial real estate's leading provider of information and analytic services. CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information and offers a suite of online services enabling clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. For more information, visit www.costar.com.